Summary

Designed with great care, the IDFC HPCL FIRST Power Credit Card offers outstanding value for people who regularly spend on gasoline and essential needs. First of all, among its key attractions are savings connected to fuel. Paying with the HP Pay app will allow cardholders to get up to 5% value back on fuel purchases at HPCL outlets in addition to a 1% fuel surcharge waiver. This fits daily commuters and car owners the best.

Apart from the fuel savings, the card offers great benefits on food shopping, FASTag recharge, and energy bill payments. For example, consumers may get up to 2.5% back in reward points on certain daily expenses. Moreover, reward points earned on the card never expire, so consumers may redeem them at any time it would be most convenient.

Along with attractive welcome benefits including ₹250 cashback on the first HPCL gasoline transaction and 5% cashback on E MI purchases within the first 30 days, the card also boasts. Thanks to these early benefits, new users find the card especially more appealing.

Introduction

Fuel costs form a major component of everyone’s monthly budget in the fast-paced environment of today. Whether you travel for business, drive to work every day, or embark on weekend-long road excursions, the expense of gasoline or diesel mounts rapidly. This is when credit cards for fuel come in handy. They are especially meant to give fuel purchases reward points, rebates, and cashback. The IDFC HPCL FIRST Power Credit Card is one credit card under much discussion.

First of all, IDFC FIRST Bank and HPCL (Hindustan Petroleum Corporation Limited) have a great relationship that produced this credit card. Their only goals are to enable consumers to simultaneously enjoy other lifestyle perks and save more on their gasoline costs. For many, collecting incentives and cashback every time you fill your tank relieves their increasing fuel costs. That is promised with the IDFC HPCL FIRST Power Credit Card.

Moreover, this card covers more than just fuel savings. It provides a broad spectrum of capabilities meant to help people in their daily lives. From discounts on eating and shopping to reward points on groceries and energy bill payments, the card has been carefully crafted for consistent consumers. If you use your credit card for daily needs, this card will help you save a lot over time.

The quick payback of up to 5% on fuel purchases at HPCL fuel stations is among the main attractions of this card. Cardholders can also receive expedited reward points in other areas, including grocery, bill payments, and online buying in addition. Later on, these reward points might be used for vouchers, interesting presents, or even cashback. Every swipe of this card returns something to the user.

What is the IDFC HPCL FIRST Power Credit Card?

Designed for those who wish to cut daily expenses and gasoline costs, the IDFC HPCL FIRST Power Credit Card is a unique kind of credit card. IDFC FIRST Bank launches it in association with HPCL (Hindustan Petroleum Corporation Limited). This card mostly targets those who routinely use their automobile and spend a lot on petrol or diesel.

First of all, this card lets you save more each time you refill your car at HPCL petrol stations. Your fuel purchases will earn extra reward points and up to 5% cashback. You thus save the more you fill your tank.

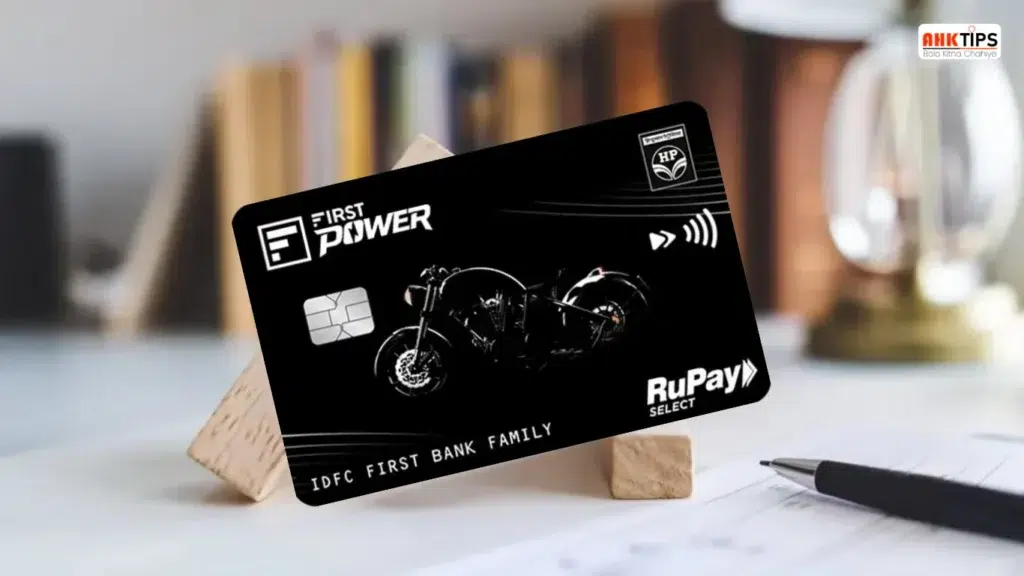

How is the design of the IDFC HPCL FIRST Power Credit Card?

The IDFC HPCL FIRST Power Credit Card boasts a simple, elegant, modern design. It initially displays a tidy and professional look that accentuates the IDFC Bank and HPCL images. Usually in stunning black or dark blue, the front side of the card seems elegant and sophisticated.

Moreover, highly visible on the card are the IDFC FIRST Bank insignia and the HPCL logo, which reflect the relationship between the two companies. This especially helps users at HPCL petrol stations to rapidly find where they can get certain benefits.

What are the benefits of the IDFC HPCL FIRST Power Credit Card?

Its main benefits are broken out here:

Fuel Efficiency

- Accelerated Rewards: Every ₹150 purchased on fuel at HPCL outlets earns 21X reward points, equating to around 3.5% value back.

- Using the HP Pay app for fuel payments will let you earn an extra 1.5% back in Happy Coins, therefore increasing your overall savings.

- On purchases between ₹400 and ₹4,000 at HPCL gasoline stations, enjoy a 1% fuel surcharge waiver.

Daily Spending Advantage

- Receive 15 reward points for each ₹150 spent on groceries and utilities, therefore providing a 2.5% return.

- Earn 15 reward points per ₹150 spent on IDFC FIRST Bank FASTag recharges, so matching a 2.5% return.

- Gain 2 reward points per ₹150 on other retail purchases.

Welcome Notes

- Get ₹250 cashback on your first HPCL gasoline purchase of ₹250 or more, 30 days after card issuance.

- Avail 5% cashback up to ₹1,000 on your first E MI transaction of ₹2,500 or more within 30 days of card activation.

extra characteristics

- Reward Point Validity: Your earned reward points never expire; hence, redemption is not limited.

- Starting at 9% annual, benefit from low and dynamic interest rates.

- Under a flat transaction cost of ₹199, enjoy 0% interest on ATM cash withdrawals till the due date.

- For flawless transactions, link your credit card to UPI apps BHIM, PhonePe, Paytm, and GPay.

Safety and Help

- Access 24/7 emergency roadside assistance valued at ₹1,399 anywhere in India.

- Benefit from the card’s other protective elements and accident insurance.

What are the fees for the IDFC HPCL FIRST Power Credit Card?

Here is a simple breakdown of the IIDFC HPCL FIRST Power Credit Card fees.

| Joining Fee | ₹199 + GST |

| Annual Fee | ₹199 + GST |

| Add-on Card Fee | No charges for additional cards for family members. |

| Finance Charges | If you don’t pay your bill in full, a charge of 0.75% per month (3.5% annually) is applied to the outstanding balance. |

| Cash Advance Fee | 2.5% of the amount withdrawn or ₹500, whichever is higher. |

| Late Payment Fee | For Statement Balance Less than Rs. 101 – Nil Rs. 101 – Rs. 500 – Rs. 150 Rs. 501 – Rs. 5,000 – Rs. 500 Rs. 5,001 – Rs. 20,000 – Rs. 750 Rs. 20,000 & above – Rs. 1,000 |

What are the criteria for getting an IDFC HPCL FIRST Power Credit Card?

1. Age Requirement:

- You should be between 18 and 65 years of age.

2. Income Requirement:

- Salaried Applicants: The minimum net monthly income is required; however, the bank fixes the amount, which can differ based on the applicant’s profile.

- Self-Employed Applicants: A minimum ITR amount is needed; the bank fixes the specific amount and can differ with applicants.

3. Employment Status:

- You should have a regular job or business with a fixed income source.

4. Credit Score:

- A CIBIL score of 700 and above is preferred for sanction.

5. Residency:

- You should be an Indian resident and have proof of a valid address.

What documents are required to get an IDFC HPCL FIRST Power Credit Card?

The documents that you will have to submit to get the IIDFC HPCL FIRST Power Credit Card are as follows:

| Identity Proof | Aadhaar card, Passport, Voter ID, Driving license, PAN card |

| Address Proof | Utility bills like electricity, water, etcRent agreement, Bank statement, or passbook with your address |

| Income Proof | Salary slip for the last 3 months, if you are a salaried employeeBank statement for the previous 3 monthsITR for self-employed persons |

| Photograph | The latest passport-sized photograph |

Where can the IDFC HPCL FIRST Power Credit Card be used?

Here is the list of places where you can use it:

- With the IIDFC HPCL FIRST Power Credit Card, you can shop for clothing, electronics, accessories, and more at almost every retail outlet, shopping mall, and e-shopping website.

- You can also use it on websites like Amazon, Flipkart, etc., and make bookings on websites like MakeMyTrip, Yatra, etc.

- You can use the card to pay for your meals in restaurants, cafes, and fast food outlets.

- You can use it to book flight, train, or bus tickets and pay for taxi, Uber, Ola, or hotel bookings.

- You can use your credit card to pay electricity and water bills, mobile bills, and internet services.

- You can use your IIDFC HPCL FIRST Power Credit Card to pay for expensive electronics or appliances through easy monthly installments (EMIs).

- The IIDFC HPCL FIRST Power Credit Card is also accepted in other countries, allowing you to make purchases and payments. It is also accepted wherever Visa is accepted.

What is the credit limit of the IDFC HPCL FIRST Power Credit Card?

The credit amount you can spend is what you are provided to you with an IIDFC HPCL FIRST Power Credit Card. It is based on your income, credit score, and other financial history when you are selected for this credit card by the bank.

For instance, if you have a credit limit of ₹50,000, you can spend up to that amount only. If you want to spend more than the limit, the bank will not consider it.

The actual credit limit varies with the person. A credit limit could be ₹30,000 for someone and ₹1,00,000 for another, or even more, considering his/her profile and financial background.

It’s essential to follow the expenses and not exceed the credit limit because when you pass this limit, then penalties get added, and your credit score also goes down.

How do you apply for an IDFC HPCL FIRST Power Credit Card?

Apply it through both these modes:

Online Application Process:

- Visit the official website of the IDFC First Bank, i.e.

- Go to ‘Cards’, followed by ‘Credit Cards’.

- On that page, you can see numerous options for credit cards issued by IDFC First Bank; for instance, you can choose the IDFC HPCL FIRST Power Credit Card.

- Just hover your cursor on the IIDFC HPCL FIRST Power Credit Card and select ‘Apply Now‘ from there.

- You will be asked to fill out your details, including your name, contact information, income details, and employment status.

- Be accurate and updated with the information provided.

- You are required to upload documents like your identity proof, address proof, income proof, and photograph, as per the list of documents mentioned above.

- After filling out the details and uploading the documents, review your application to make sure everything is correct.

- Apply online through the application form.

- The bank will check your application after you submit it. They can ask for extra documents or information if required.

- You will be informed about the status of your application, and if approved, your card will be delivered to you.

Offline Application Process:

- You can walk into the nearest IDFC First Bank branch to apply for the IDFC HPCL FIRST Power Credit Card.

- Request the credit card application form for the IIDFC HPCL FIRST Power Credit Card. They will provide you with the form and proceed accordingly.

- Fill in the details in the application form wherever it is required. Care should be taken to ensure that all the information about personal details, income, and jobs provided by the applicant is correct.

- Along with the form, furnish the relevant documents. The list of documents includes Identity proof, Address proof, Proof of income, and a passport photograph.

- Your application will be processed, and your information will be cross-checked at the bank level.

- In case of successful completion, the bank will sanction the credit card with a reply and forward it to the registered address.

- You will receive the IIDFC HPCL FIRST Power Credit Card by post at the same postal address.

- Once you receive your card, you need to activate it by following the instructions in the envelope through the IDFC First Bank Card website, mobile app, or customer service.

- For security purposes, you must set your PIN (Personal Identification Number) before you can start using your credit card.

Would getting an IDFC HPCL FIRST Power Credit Card in 2025 be right?

Getting an IIDFC HPCL FIRST Power Credit Card in 2025 can be a good option if you require a credit card with great offers, especially for those who shop for lifestyle products. The reward is excellent and comes with purchasing items such as jewelry. The bank also provides discounts and easy access to the EMI facility.

IDFC First Bank is also a strong bank with high customer service, so it is dependable. But don’t forget that you should ensure you can handle your credit responsibly in terms of paying the bills and keeping your credit from exceeding its limit. Provided that you are stable in terms of income and you have good credit, it might be a very good option in 2025.

Conclusion

All things considered, those who routinely spend on gasoline and daily purchases would be wise and valuable users of the IDFC HPCL FIRST Power Credit Card. It is especially meant to enable consumers to save money in a straightforward and useful manner. Whether you are shopping, paying utilities, filling up your car at an HPCL petrol pump, or even recharging your FASTag, this card offers valuable incentives and perks that mount up over time.

Furthermore, the card speaks more about convenience than merely discounts. UPI compatibility, contactless payment choices, and 24×7 roadside assistance help to fit your daily routine. When you initially start using it, the introductory offers—like EMI transactions and fuel cashback—make it much more appealing.

One other great advantage is that the reward points never run out. You may so gather them at your speed and redeem them anytime you so like. Apart from that, the annual cost is quite reasonable; if your expenditure fits, it may even be waived.

Frequently Asked Questions (FAQ’s)

Ans: No, the reward points never expire; hence, you may use them whenever you wish without regard to time restrictions.

Ans: This card does support UPI payments. For quick and safe payments, link it to apps including PhonePe, Google Pay, Paytm, and BHIM.

Ans: Your reward points may be redeemed via the IDFC FIRST Bank mobile app or website. Gift cards, shopping, vacation, cashback—all of which can be redeemed from the points.

Ans: Yes, you can get 5% cashback (up to ₹1,000) on your first EMI transaction of ₹2,500 or more if you turn a purchase into E MI inside the first 30 days of card issuing.

Ans: To stop any use, you should immediately call IDFC FIRST Bank customer care or block the card with the bank’s mobile app. Regarding a card replacement, the bank will assist you.