Summary

Alright, here’s the deal with the IndusInd Bank Pinnacle World Credit Card—it’s not just another piece of shiny plastic for your wallet. This thing’s the Swiss Army knife of credit cards for anyone who likes rolling in style, flexing a bit, and getting all sorts of extras just for swiping it.

You rack up points on all the good stuff—flights, shopping online ‘til 2 am, grabbing coffee, you name it. Then, those points? I mean, who doesn’t love free travel or a little retail therapy?

And, oh, don’t sleep on the travel perks. This card’s your golden ticket to over 1,400 airport lounges worldwide (yeah, free snacks and Wi-Fi while everyone else crowds by the gate). Perfect if your passport’s got more stamps than your local post office.

Feel like swinging at some golf balls or catching a movie? Go for it—free golf games and discounted movie tickets are just part of the package. Plus, the round-the-clock concierge could probably book you a unicorn if you asked nicely enough. Oh, and peace of mind? Covered, thanks to all the emergency stuff like Auto Assist and fraud protection. This card’s your VIP pass to living the good life, minus the stress.

Introduction

Look, let’s just cut to the chase—these days, having a credit card isn’t just for people out here splurging on Ferraris or buying yachts for their cats. It’s just… smart. And if you’re really in the “living life in the fast lane” crowd (or, let’s be honest, just like the good stuff), then the IndusInd Bank Pinnacle World Credit Card is flexing at you from the shelf.

You see, this isn’t your garden-variety plastic rectangle. It’s like the VIP backstage pass of credit cards. We’re talking perks left and right—especially if you love to travel, can’t say no to a little luxury, or just want to rack up rewards while spending on stuff you were gonna buy anyway. From swanky lounges to fancy dining, this card’s serving up the good life on a shiny silver platter, and honestly, who could say no?

Swipe this thing and you’re not just paying, you’re almost getting a high-five from the universe every time. Spend abroad? Points. Book flights or hotels? Points. That late-night online shopping haul you’re pretending not to remember? You guessed it. More points. And you don’t have to hoard them like a dragon—they give you vouchers, bookings, or random cool stuff in return.

And let’s not forget the fancy-pants privileges. Want a prime table at that restaurant with a six-month waiting list? Sorted. Spa day? Obviously. Need to feel like royalty for five minutes at the airport? Lounge access at both domestic *and* international terminals. Honestly, you’ll be looking forward to layovers.

What is the IndusInd Bank Pinnacle World Credit Card?

Alright, let’s ditch the suit-and-tie language for a second. The IndusInd Bank Pinnacle World Credit Card? Honestly, it’s kinda made for folks who love living it up—think swanky vacations, shopping sprees, all that jazz. Swipe it, and you rack up more reward points, especially if you’re blowing cash on travel, retail therapy, or splurging overseas. Those points? You can trade ’em in for flights, plush hotels, or, hey, just grab some fancy gift vouchers if you want.

And here’s the cool bit—flash this card and stroll right into those airport lounges (not just in India, but pretty much anywhere they let you in), which is a lifesaver if you travel a lot. Toss in some travel insurance, zero fuel surcharge drama at gas stations, plus shopping protection—sounds like a pretty sweet setup if you don’t mind feeling a bit spoiled.

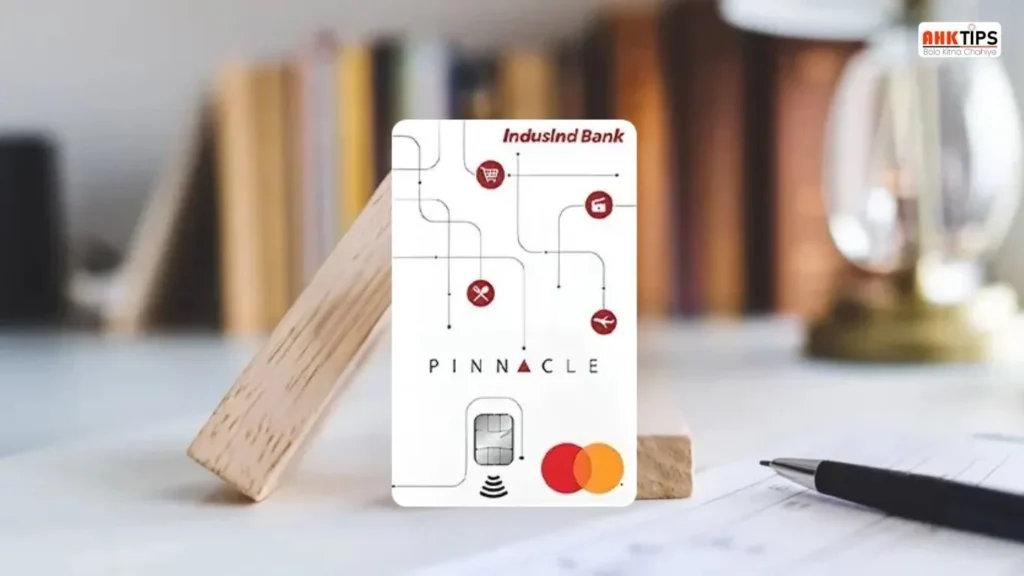

How is the design of the IndusInd Bank Pinnacle World Credit Card?

Man, the IndusInd Bank Pinnacle World Credit Card just oozes style. You pick it up, and bam—dark finish, glossy shine, the whole “I’ve got my life together” vibe. Honestly, it’s got that luxury thing going on, but not in an over-the-top, look-at-me way. More like, “Yeah, I deserve something nice and I know it.”

They kept the design pretty clean—none of that gaudy mess you see on some cards. The cardholder’s name, the IndusInd logo—they stand out, but not in an in-your-face way. Just crisp, simple, and somehow still kinda flashy. Oh, and they didn’t skimp on the techie stuff either. There’s a chip, so you’re not stuck swiping like it’s 2008, and you can just tap and go—great for when you’re running late and still want to look cool at the coffee shop. Safe, fancy, and practical… honestly, that’s the trifecta.

What are the benefits of the IndusInd Bank Pinnacle World Credit Card?

Perks of the IndusInd Bank Pinnacle World Credit Card (But, Y’know, The Way *People* Talk):

1. Points For Pretty Much Breathing

- Swipe your card online for shopping sprees? You’ll bag 2.5 points per ₹100, no messing around.

- Booking flights or hotels from your laptop? Not bad—1.5 points per ₹100.

2. Fancy “Hey, Welcome!” Freebies

- Sign up? Boom. They shower you with welcome goodies—think lush hotel vouchers, branded swag, that sorta thing. Real “treat yourself” energy.

3. Travel Stuff Because Why Not

- Priority Pass: Basically, get into 1,400+ lounges worldwide. Free snacks, snooze chairs, the works.

- Travel Plus: If you’re in a foreign airport, they cover your lounge fees too.

4. Livin’ That Lifestyle (Or Faking It)

- Golf: You get a free game *and* a lesson every month—love it or just want an excuse to swan around in plaid trousers.

- Movies: That classic “buy-1-get-1” on tickets? Up to three times a month, max ₹200 off each. Time to see those movies everyone won’t shut up about.

5. The Butler You Never Had

- Got questions or need things booked? Their concierge is on standby, anytime: flights, hotels, fancy dinners, that show your spouse said they want tickets for, or last-minute “Oh my god, I forgot their birthday!” gifts.

6. Insurance You Want

- Total Protect: The Card gets swiped by someone else? As long as you report it within 48 hours, you’re cool.

- Counterfeit Fraud Protection—yep, they cover that modern horror story too.

7. Car Trouble? Chill

- Break down at 2 AM? Need fuel or help with a flat? Their team has your back around the clock, anywhere.

- Long story short: If you’re allergic to ordinary credit cards, this one’s got more bells and whistles than a parade float. Not too shabby, eh?

What are the fees for the IndusInd Bank Pinnacle World Credit Card?

Here is a simple breakdown of the IndusInd Bank Pinnacle World Credit Card fees.

| Joining Fee | Rs. 14,999 + GST |

| Annual Fee | Nil |

| Add-on Card Fee | No charges for additional cards for family members. |

| Finance Charges | If you don’t pay your bill in full, a charge of 3.83% per month (46% annually) is applied to the outstanding balance. |

| Cash Advance Fee | 2.5% of the amount withdrawn or ₹500, whichever is higher. |

| Late Payment Fee | For Statement Balance Less than Rs. 101 – Nil Rs. 101 – Rs. 500 – Rs. 150 Rs. 501 – Rs. 5,000 – Rs. 500 Rs. 5,001 – Rs. 20,000 – Rs. 750 Rs. 20,000 & above – Rs. 1,000 |

What are the criteria for getting an IndusInd Bank Pinnacle World Credit Card?

1. Age Requirement:

- You should be between 18 and 65 years of age.

2. Income Requirement:

- Salaried Applicants: The minimum net monthly income is required; however, the bank fixes the amount, which can differ based on the applicant’s profile.

- Self-Employed Applicants: A minimum ITR amount is needed; the bank fixes the specific amount and can differ with applicants.

3. Employment Status:

- You should have a regular job or business with a fixed income source.

4. Credit Score:

- A CIBIL score of 700 and above is preferred for sanction.

5. Residency:

- You should be an Indian resident and have proof of a valid address.

What documents are required to get an IndusInd Bank Pinnacle World Credit Card?

The documents that you will have to submit to get the IndusInd Pinnacle World Credit Card are as follows:

| Identity Proof | Aadhaar card, Passport, Voter ID, Driving license, PAN card |

| Address Proof | Utility bills like electricity, water, etcRent agreement, Bank statement, or passbook with your address |

| Income Proof | Salary slip for the last 3 months, if you are a salaried employeeBank statement for the previous 3 monthsITR for self-employed persons |

| Photograph | The latest passport-sized photograph |

Where can the IndusInd Bank Pinnacle World Credit Card be used?

Here is the list of places where you can use it:

- With the IndusInd Bank Pinnacle World Credit Card, you can shop for clothing, electronics, accessories, and more at almost every retail outlet, shopping mall, and e-shopping website.

- You can also use it on websites like Amazon, Flipkart, etc., and make bookings on websites like MakeMyTrip, Yatra, etc.

- You can use the card to pay for your meals in restaurants, cafes, and fast food outlets.

- You can use it to book flight, train, or bus tickets and pay for taxi, Uber, Ola, or hotel bookings.

- You can use your credit card to pay electricity and water bills, mobile bills, and internet services.

- You can use your IndusInd Pinnacle World Credit Card to pay for expensive electronics or appliances through easy monthly installments (EMIs).

- The IndusInd Bank Pinnacle World Credit Card is also accepted in other countries, where you can make purchases and payments. It is also accepted wherever Visa is accepted.

What is the credit limit of the IndusInd Bank Pinnacle World Credit Card?

The credit amount you can spend is what you are provided to you with an IndusInd Bank Pinnacle World Credit Card. It is based on your income, credit score, and other financial history when you are selected for this credit card by the bank.

For instance, if you have a credit limit of ₹50,000, you can spend up to that amount only. If you want to spend more than the limit, the bank will not consider it.

The actual credit limit varies with the person. A credit limit could be ₹30,000 for someone and ₹1,00,000 for another, or even more, considering his/her profile and financial background.

It’s essential to follow the expenses and not exceed the credit limit because when you pass this limit, then penalties get added, and your credit score also goes down.

How do you apply for an IndusInd Bank Pinnacle World Credit Card?

Apply it through both these modes:

Online Application Process:

- Visit the official website of the IndusInd Bank, i.e.

- Go to ‘Cards’, followed by ‘Credit Cards’.

- On that page, you can see numerous options for credit cards issued by IndusInd Bank; for instance, you can choose the IndusInd Bank Pinnacle World Credit Card.

- Just hover your cursor on the IndusInd Bank Pinnacle World Credit Card and select ‘Apply Now‘ from there.

- You will be asked to fill out your details, including your name, contact information, income details, and employment status.

- Be accurate and updated with the information provided.

- You are required to upload documents like your identity proof, address proof, income proof, and photograph, as per the list of documents mentioned above.

- After filling out the details and uploading the documents, review your application to make sure everything is correct.

- Apply online through the application form.

- The bank will check your application after you submit it. They can ask for extra documents or information if required.

- You will be informed about the status of your application, and if approved, your card will be delivered to you.

Offline Application Process:

- You can walk into the nearest IndusInd Bank branch to apply for the IndusInd Bank Pinnacle World Credit Card.

- Request the credit card application form for the IndusInd Bank Pinnacle World Credit Card. They will provide you with the form and proceed accordingly.

- Fill in the details in the application form wherever it is required. Care should be taken to ensure that all the information about personal details, income, and jobs provided by the applicant is correct.

- Along with the form, furnish the relevant documents. The list of documents includes Identity proof, Address proof, Proof of income, and a passport photograph.

- Your application will be processed, and your information will be cross-checked at the bank level.

- In case of successful completion, the bank will sanction the credit card with a reply and forward it to the registered address.

- You will receive the IndusInd Bank Pinnacle World Credit Card by post at the same postal address.

- Once you receive your card, you need to activate it by following the instructions given in the envelope, either through the IndusInd Bank Card website, mobile app, or by calling their customer service.

- You must set your PIN (Personal Identification Number) for security purposes before you can start using your credit card.

Would getting an IndusInd Bank Pinnacle World Credit Card in 2025 be right?

Getting an IndusInd Bank Pinnacle World Credit Card in 2025 can be a good option if you require a credit card with great offers, especially for those who shop for lifestyle products. The reward is excellent and comes with purchasing items such as jewelry. The bank also provides discounts and easy access to the EMI facility.

IndusInd Bank is also a strong bank with high customer service, so it is dependable. But don’t forget that you should ensure you can handle your credit responsibly in terms of paying the bills and keeping your credit from exceeding its limit. Provided that you are stable in terms of income and you have good credit, it might be a very good option in 2025.

Conclusion

Alright, so here’s the real talk: the IndusInd Bank Pinnacle World Credit Card isn’t just another shiny credit card to stuff in your wallet. Nope, this one’s packing serious heat—luxury vibes, a load of perks, you name it. We’re talking reward points on stuff you’d buy anyway, and the airport lounge thing? It just makes layovers suck a little less, honestly.

And yeah, they went heavy on the pampering—free golf sessions (even if you have the world’s worst swing), movie ticket deals (date night sorted), and some 24/7 concierge deal that kinda makes you feel like royalty. Not gonna lie, sometimes it’s the little things that just make life smoother.

Jetsetting? You’re sorted there too. They’ve tossed in travel insurance, Priority Pass, road assistance—a pretty tight safety net, especially if adventure likes to surprise you. Oh, and don’t even stress if your card vanishes into the Bermuda Triangle, that is your bag; this Total Protect thing has your back against weird fraud transactions.

Frequently Asked Questions (FAQ’s)

Ans: The response is indeed, some Indian golf courses grant one free lesson and one free golf game per month.

Ans: Your reward points are redeemable via the IndusInd Bank mobile app or website. Among the options are flight tickets, hotel accommodations, gift cards, and souvenirs.

Ans: Response Indeed, for purchases between ₹400 and ₹4,000, you receive a 1% fuel price waiver at petrol stations in India.

Ans: Either visiting your closest IndusInd Bank branch or using the official IndusInd Bank website will let you apply online. You will have to send recent passport-sized pictures, ID proof, address proof, and income documentation.

Ans: Any Indian resident between the ages of 21 and 65 who has a consistent income and a clean credit record may apply for this card. Usually, 750 or higher, a strong credit score is advised.