Summary

Getting a loan without paying interest may seem like a dream, yet 0% interest loan opportunities are available when you know where and how to find them. These loans can provide funding for purchases, cover bills, or debt consolidation with no added costs. This guide delves into what 0% interest loans are, how they operate, and how to get one responsibly.

What Is a Zero Percent Interest Loan?

A 0% interest loan is a financial instrument in which you don’t have to pay interest on the loan amount for a certain duration. In contrast to a normal loan, in which interest accumulates over time, these loans enable you to only repay the loan amount, perhaps saving you a lot of money. These are usually provided by credit card companies, retailers, or financial institutions as promotion to get customers on board.

How Do Zero Percent Interest Loans Work?

These loans have a promotion period when no interest is paid. This can last several months or years, depending on an offer or lender. After this promotion is over, interest may accumulate on an outstanding balance at a regular rate, sometimes a high rate. The terms, including how long a 0% will remain available and how much needs to be repaid, must be understood to get the most from it.

Types of zero Interest Loans

There are different 0% interest loan options, with all catering to unique financial needs. Some such options include credit card balance transfers, purchase financing, and personal loans with promotion rates. Understanding what differentiates them can get you to decide on the most suitable one for you.

Credit Card Balance Transfers

Several credit cards provide 0% interest on balance transfers for a promotional term, commonly 6 to 21 months. This can help you transfer outstanding credit card debt to a new card and repay it interest-free until the promotion expires. There can be a balance transfer fee, usually 3-5% of the transferred balance.

Purchase Financing

Manufacturers and retailers, particularly for high-priced merchandise such as furniture, electronics, or vehicles, may also offer 0% interest rates. These deals have you paying off the purchase over a duration without interest, as long as you keep to the repayment timeline. Missing a payment or not paying off the balance by the end of a promotion can activate deferred interest.

Personal Loans with Promotional Rates

There are also personal loans with 0% interest for a short duration, though they are less usual. These are usually with specific uses, such as for healthcare or repairing a house, and are made by credit unions or specialty lenders.

Benefits of a Zero Percent Interest Loan

Using a 0% interest loan can provide considerable financial benefits when utilized effectively. The advantages make them an attractive choice for borrowers wishing to save money or manage cash flows.

Cost Savings

The most immediate benefit is avoiding interest charges over the promotion term. By making only the principal payment, you lower the total price of borrowing, and it is less expensive to afford bigger purchases or debt repayments.

Flexibility in Budgeting

Having no interest on an installment loan means you can put more of your funds towards paying off the principal or other financial goals. This freedom is particularly useful when dealing with unexpected bills or reaching long-term financial objectives.

Debt Consolidation Opportunities

For individuals with high-interest credit card debts, a 0% interest balance transfer can keep payments manageable and lower expenses. Combining several debts into a single payment can also enhance financial organization.

Risks and Pitfalls to Avoid

Although 0% interest loans are appealing, there are risks involved that have a negative effect on them unless managed with prudence. It is vital to learn about these shortcomings to make proper decisions.

Deferred Interest Traps

Certain 0% interest promotions, such as with retail financing, contain deferred interest terms. Should you not repay the entire balance at the conclusion of the promotion, you will be paying interest on the original amount, rather than just on the outstanding balance.

High Post-Promotional Rates

After the 0% interest rate term is over, the rate on any outstanding balance may rise to a normal or even above-average rate. This can really escalate the price of the loan if you didn’t repay it on schedule.

Fees and Hidden Costs

The savings from a 0% interest loan will be offset by balance transfer charges, an annual fee, or a late payment charge. Carefully reading fine print and knowing all costs involved is very important.

Temptation to Overspend

Having the opportunity for 0% interest borrowing may create impulsive buying or borrowing more than you can reasonably afford to repay. It is crucial to borrow only what you require and will be able to repay.

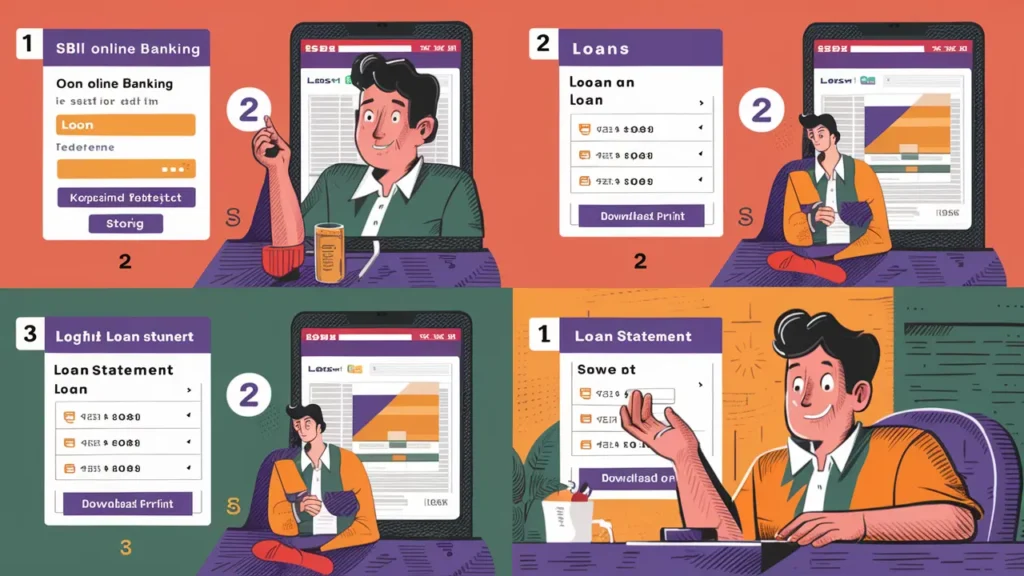

Steps to Secure a Zero Percent Interest Loan

It requires planning and research to locate and become eligible for a 0% interest loan. Here are steps you can take to obtain one and how to use it with maximum benefit.

Step 1: Assess Your Financial Needs

Before taking out a loan, decide beforehand what you will use it for and how much you can borrow. For a purchase, debt consolidation, or other purpose, having a plan will ensure that you borrow responsibly.

Step 2: Check Your Credit Score

Usually, most 0% interest offerings, like credit card balance transfer and promotionals, are only open to consumers with excellent or good credit scores. Know your credit rating and check for inaccuracies on your credit report. The better your rating, the greater the probability that you will qualify for better offerings.

Improving Your Credit Score

If credit can be improved, improve it before applying. Pay down current debt, keep payments current, and avoid unnecessary new credit lines. Even modest improvements will have an impact.

Step 3: Research Available Offers

Compare different 0% interest loan programs provided by credit card issuers, retailers, and financial organizations. For such loans, take terms with longer promotion phases, no or negligible charges, and payment terms that align with your financial repayment potential.

Where to Find 0% Interest Offers

Comparison websites, retailer websites, and financial institutions also promote 0 interest offers. Credit unions and community banks also provide competitive consumer loan rates.

Step 4: Read the Terms and Conditions

Make a note of terms and conditions of 0% interest promotion. Ask how long promotion will last, how termination rate is determined, what charges are imposed, and late payment or missed payment charges. Check what will happen when you don’t repay by payment due dates.

Step 5: Apply for the Loan

After selecting an offer, follow through by making an application. For credit cards, this will usually involve filling out personal and financial information online or in stores. For retail credit, point-of-purchase application in stores may be required.

Step 6: Create a Repayment Plan

For optimal utilization of a 0% interest loan, it is best to repay within the promotion term. Divide by the months to determine how much you will have to send each month. Put automatic payments in effect to avoid missing a payment deadline.

Tips for Sticking to Your Repayment Plan

Spend frugally in order to keep loan repayments as an urgent priority, and do not continue to make purchases on the credit card or loan to push yourself financially further than you need to. Whenever possible, make extra payments to reduce the repayment term.

Best Practices for Managing a Zero Percent Interest Loan

After taking out a 0% interest loan, it is important to handle it wisely to avoid making errors and save as much as possible. Here are some tips to lead you to success.

Monitor Your Payments

Monitor your payment plan and balance outstanding. Use online banking websites or apps to keep yourself on track and organized with repayment schedules.

Avoid New Debt

Adding more debt, especially on the same credit card with a balance transfer, will complicate repayment and create financial stress. Pay off the 0% interest loan first.

Plan for the End of the Promotional Period

If paying off the total amount before the promotion period is not possible, you may want to consider paying off the total on a different 0% interest promotion or refinance with a low-rate loan to maintain low costs.

Communicate with Your Lender

If you are having financial troubles, talk with your lender about options. Some will grant hardship programs or payment schedules that will help you avoid penalties.

Common Scenarios for Using Zero Interest Loans

Learning how others use 0% interest loans can also provide you with ideas on how you can utilize them. Following are some situations when these loans can truly come in handy.

Financing a Major Purchase

If you’re planning to buy a new appliance, piece of furniture, or electronics, a retailer’s 0% interest promotion will spread the payment incrementally over time without an additional fee. Just be sure you can keep paying on the desired timeline to avoid paying deferred interest.

Paying Off Credit Card Debt

High interest credit card debt is a financial burden. Balance transfer to a 0 interest card allows you to get out of debt faster without paying interest and maintain low monthly payments.

Covering Unexpected Expenses

For unexpected situations like a car breakdown or an unplanned hospital bill, a 0% interest credit card or personal loan can provide relief at no interest charge to you, a temporary reprieve to get yourself sorted out.

The Pros of zero Interest Financing

No Interest Charges

The most apparent advantage of 0% finance is that you don’t have to pay anything in interest over the promotion duration. This will save you a great sum compared to other credit cards or loans, where interest may stack up rapidly. When you have paid off the entire amount within the term provided, you will only have paid for the product itself, not a penny more.

Flexible Payment Terms

One benefit of 0% interest financing is also its flexibility when it comes to payment terms. Based on the promotion, you can select repayment terms from several months to several years. This allows you to break down the price of your purchase into easier monthly payments.

Opportunity to Build Credit

By paying on time, you can enhance your credit rating. On-time payments have a positive impact on lenders, as it builds a solid credit history. In an effort to improve your credit rating, 0% finance is an opportunity to do so without paying interest.

The Cons of zero Interest Financing

High Post-Promotional Interest Rates

One key danger with 0% interest financing is exposure to high interest rates once the promotion has ended. In case you don’t repay the balance before it is due, the balance may get charged at much higher rates—often higher than 20%. This may create a much greater debt than you first anticipated.

Hidden Fees and Penalties

Not all 0% interest loans are as clear-cut as they appear. Most have hidden charges, like missed payment charges or activation charges if you ever miss a payment date. These charges can mount high, making what initially looks like a loan with no charges very expensive indeed.

Temptation to Overspend

Having 0% interest financing available can lead to you spending more than you should. The fact that there is no interest involved can make big-ticket purchases more attractive, causing you to buy more than you require or can really afford. Staying disciplined and resisting temptation to overextend yourself is critical.

Tips for Using zero Interest Financing Wisely

Stick to a Budget

Prior to selecting 0% financing, review your expenses to make sure that you will be able to afford making the payments. Don’t let yourself get tempted to buy more than you intended, and make sure that monthly payments will not disrupt your financial routine.

Alternatives to zero Interest Loans

If you can’t get or don’t qualify for a 0% interest loan, there are other means to accomplish these same financial objectives. Investigating alternative options will expand your options.

Low-Interest Personal Loans

There are some low-rate personal loans available, particularly for creditworthy borrowers. Although not without interest, low-rate personal loans can prove to be an efficient way to fund major purchases.

Credit Union Loans

Credit unions usually have favorable loan terms such as low or special interest rates. Membership is sometimes mandatory, but there may be savings worth it.

Payment Plans

Some stores, health care providers, or services providers provide interest-free payment plans on a direct basis. The payment plans act like 0% interest loans except they don’t involve a formal loan application.

Saving in Advance

If one has enough time, it is best to save to buy or cover an expense rather than borrow. Having an emergency fund or saving every month can secure financial stability.

Conclusion

Acquiring a 0% interest loan can prove to be a prudent financial move if you are careful and do this with responsibility. Understanding terms, charting out repayments, and avoiding pitfalls assist you in making these loans work for saving and achieving financial goals. A purchase on credit, consolidating debts, or paying unannounced bills is all acceptable as long as you borrow responsibly and educate yourself.

Frequently Asked Questions (FAQ’s)

Ans: While on the surface they sound perfect, 0 interest loans are real offers, but with strings attached. The companies utilize them as marketing tools, with hope that some will need to pay charges or interest rates once a promotion has ended. Planning is required to avoid these charges.

Ans: Qualification is generally on the basis of a good credit and financial history. Your creditworthiness is evaluated by lenders to determine eligibility, therefore enhancing credit scores will enhance prospects.

Ans: There will be a penalty in terms of late charges or loss of interest rate of 0%. Deferred interest may come into play in some cases. There should always be priority to make timely payment.

Ans: Shopping around for offers from various sources, comparing terms, and checking lender ratings will help you determine which is best for you. Financial advisors and online calculators can also help.