Summary

Personal loan settlement is a legal alternative when debtors cannot pay back the whole outstanding amount owed due to financial problems, such as job loss or illness. The bank closes the account with a lesser one-time payment instead of a full refund. This prevents legal action, fast lowers symptoms, and helps one to get peace of mind. On the other hand, it hurts your credit score, reduces future loan acceptance chances, and, should it be reported falsely, could cause legal issues. Borrowers have to weigh the benefits against the disadvantages before making decisions. Though it’s not for everyone, settlement helps in trying conditions. Those who want to borrow money straightforwardly or who can pay it back with adjustments should stay away. Another pertinent analogy is between loan restructuring and settlement, since the former maintains a superior credit condition and long-term financial freedom.

Introduction

Paying back a personal loan might prove tough under trying conditions, including job loss, physical problems, or financial challenges. Should it prove challenging to pay back the entire loan, personal debt settlement could be a last resort. Banks agree under a loan settlement to release your debt for a one-time reduced payment. Usually, this is offered when the bank believes you truly cannot afford more. Though it offers immediate relief and helps stop harassment, the settlement has long-term effects, especially on your credit score and future loan eligibility. This page details personal debt settlement, its advantages and disadvantages, who should consider it, and how it differs from loan restructuring. Knowing this will enable you to make informed, prudent financial decisions considering your current situation.

Top Advantages of Getting a Personal Loan with Your Bank

Fighting to clear your personal loan? A loan settlement helps if complete payments seem unachievable. Although it could temporarily reduce your credit, for borrowers in severe financial crisis the advantages of personal loan settlement usually exceed the drawbacks.

What Is Personal Loan Settlement?

To settle a personal loan, the bank agrees to take a one-time, reduced payment rather than the whole outstanding sum. Usually given when a borrower is unable to pay the entire outstanding for illness, job loss, financial difficulty, or other valid reason is this.

Key Benefits of Personal Loan Settlement

Immediate Financial Relief

The instant reduction of financial load is one of the main benefits. Not having to pay the whole outstanding debt helps you to control your money and free you to devote income to either emergency or essential necessities.

Avoid Legal Action and Recovery Harassment

Loan settlement lets banks avoid sending recovery agents or starting legal action. Your account closes, and no more action is taken once the bank verifies your proposal and the agreed-upon payment is subtracted.

Faster Debt Closure

A lump amount payment will immediately close your loan account. This lets you start again free from long-term EMIs or growing concern about interest rates.

Additional Advantages for Borrowers

Mental Peace and Stability

Your judgment and mental health may suffer from financial anxiety. By facilitating loan settlement, bringing mental tranquillity lets you concentrate on increasing your income or job.

Possible Waivers on Interest and Penalties

Oftentimes, banks consent to have late payment fines, penalties, or accumulated interest taken off during settlement. Here, your total debt payback could indicate notable savings.

Final Notes on Using Settlement Wisely

Although a settlement lowers your credit score, usually it is a better choice than continuous default, which leads to legal issues and declining credit. Settlement could be the turning point towards financial recovery if you have great planning and regularly raise your credit.

Knowing the advantages of personal loan settlement will help you to decide, depending on your present circumstances and desired future objectives.

Hidden Disadvantages of Personal Loan Settlement You Must Know

When you are unable to pay back in whole, settling a personal loan could appear like a simple fix. Although it could provide some respite, debtors should be informed of the negatives of personal loan settlement before deciding. Often disregarded during times of financial difficulty are long-term financial and legal ramifications of settlement.

Understanding What Loan Settlement Means

A loan settlement is a compromise between you and the lender whereby you agree to pay less than the whole outstanding debt. Lenders provide this choice when they think the borrower cannot pay back the whole amount and continuous recovery initiatives will not be efficient.

Major Drawbacks of Personal Loan Settlement

Negative Impact on Credit Score

The way personal loan settlement affects your credit report is one of the most major negatives. Once you pay off a loan, the lender notes the account as “settled,” instead of “closed,” or “paid in full.” This suggests the borrower fell short of the initial terms.

A “settled” status stays on your credit report for several years and can drop your credit score. Future lenders could see you as high-risk, which would limit your loan availability or raise the proposed interest rate.

Limited Access to New Loans or Credit Cards

Many borrowers discover it more difficult to be approved for future borrowing once they have paid off a debt. Settlement raises red flags for most banks and non-banking financial companies. It implies the borrower struggled to pay back in the past.

Should a new loan be accepted, the terms could be tighter—that is, with fewer ceilings or higher rates. One long-term negative of personal loan settlement that can compromise financial flexibility is limited access.

Legal Risks if Settlement Terms Are Unclear

Should the settlement agreement be improperly recorded, the borrower might find legal issues down road. Should the borrower fail to satisfy the terms or if the documentation is lacking, the lender may return to seek the outstanding sum.

This danger arises whether settlements are paid informally or through third parties. Make sure all paperwork is in order and the settlement is conducted through official channels always.

Emotional Relief vs. Financial Reality

While debt settlement provides some momentary piece of mind, it does not clean the financial record. Sometimes borrowers believe that paying off a debt will cause the problem to vanish totally. Many times, this misinterpretation results in unexpected results such as credit refusal or future legal notifications.

No Dues Certificate May Not Be Issued

Sometimes, lenders might delay or refuse to provide a No Dues Certificate upon settlement. It gets challenging to show that the account is cleared without this record. Many people find out too late that one of the quiet negative effects of personal debt settlement is.

Difficulty in Rebuilding Financial Reputation

Rebuilding your financial reputation takes time, even once a personal loan is paid off. Though stable income, careful financial behaviour, and regular repayment of new credit help, the negative record from the settlement is still evident for years. Those borrowing have to be ready for a slow comeback.

Who Should Consider Personal Loan Settlement and Who Should Avoid It?

Often considered as a final choice when a borrower cannot fully repay their loan is personal loan settlement. Though it provides temporary relief, it is not a good choice for everyone. Making the best financial option requires knowing who should avoid personal loan settlement and who should go for it.

What Is Personal Loan Settlement

Loan settlement is the process by which the borrower and lender decide to conclude the loan account by paying a smaller amount than the total outstanding debt. Usually, this follows the loan turning into a non-performing asset, and the likelihood of further repayment becomes doubtful.

The lender presents this choice to recoup some of the money instead of starting protracted legal actions. Still, the settlement has long-term effects and influences your credit record.

Who Should Go for Personal Loan Settlement

Borrowers Facing Genuine Financial Hardship

Loan settlement is a relief choice for borrowers in dire financial circumstances such job loss, medical difficulties, or business failure. Should you find yourself unable to pay back the loan despite best efforts, debt settlement can assist you escape more financial and legal strain.

Those without a clear, consistent source of income or a reasonable means of clearing the entire outstanding debt are in this group.

Those with No Plans for New Credit shortly

The credit score impact may have less effect on borrowers who intend not to apply for credit cards or loans soon. Those who are not looking for quick loans may pick settlement as a means of handling present deb,t since a settled status can stay on your credit report for several years.

Who Should Avoid Personal Loan Settlement

Individuals with Future Financial Plans

Settlement could compromise your eligibility, ty whether your next several years call for a credit card, vehicle loan, or even a home loan. A settled account makes lenders wary since it shows the borrower failed to meet the initial commitment.

If future financial credibility counts to you, then knowing who should go for personal loan settlement becomes very important. Under such circumstances, reorganising the loan or consulting a credit counsellor could be preferable choices.

Borrowers Who Can Repay with Adjustments

Sometimes a repayment problem is transient. You would be better off looking at loan modification or an extended repayment schedule if you hope your income to rise or if you can cope with some tweaks. Settlement should only be taken into account after all other ways of repayment have run out.

Those Without Written Confirmation

Settlement without appropriate records runs the danger. Should the lender fail to send a formal settlement letter together with a No Dues Certificate, the borrower can find themselves in legal or financial hot water. Should your lender deviate from the proper procedure, steer clear of loan settlement and consult governmental channels for assistance.

Understanding the Long-Term Trade-Off

Knowing who should settle a personal debt helps you balance long-term impact with temporary relief. It influences your creditworthiness and future borrowing choices, even while it can limit recuperation activities and lower stress.

Before deciding on this road, borrowers have to thoroughly assess their financial status, ability for payments, and future objectives. When there are no other reasonable options, settlement should never be a snap decision but rather a well thought out one.

How Personal Loan Settlement Affects Your Future Loan Eligibility

Should it prove difficult to pay back a personal loan, settlement seems like a logical solution. Many borrowers, meanwhile, are not aware that choosing settlement can affect future borrowing. Understanding how loan eligibility changes after personal loan settlement will help you make better financial decisions.

What Is Personal Loan Settlement

Loan settlement follows from a borrower unable to pay back the total outstanding debt. Instead, the lender offers to liquidate the account paying a lower lump sum. Usually, this is taken into account when missed payments render the loan non-performing.

Settlement reduces the immediate strain, but it is not the same as completely debt clearance. The assessment of future credit applications by lenders depends much on this difference.

Credit Report Status After Settlement

Marked as “Settled”, not “closed”

Once the loan is paid off, lenders mark the account with credit bureaus. It’s written as “settled,” not as “closed” or “paid in full.” This status suggests that the borrower did not repay the entire loan within the terms specified originally.

This entry shows on the credit record for many years. It lowers the credit score and compromises your financial reputation. Any future lender looking over your credit history will find this record and could regard your application as dangerous.

How It Affects Loan Eligibility After Personal Loan Settlement

Lower Chances of Loan Approval

Lenders closely review credit records before authorising new loan applications. A settlement entry can immediately reject your current financial condition even if it is good. This is so since it raises issues on behavior related to payback.

Once a settlement appears on your file, credit card, vehicle loan, or even house loan applications could be under closer inspection.

Less Favourable Loan Terms

Should a loan be authorised, the terms may not be in your best interest. Banks could provide smaller amounts, better loan rates, or shorter payback terms. This is how loan eligibility after personal debt settlement gets restricted, therefore limiting borrowing and raising its cost.

Impact on Pre-Approved or Instant Loans

Personal loan settlement might also affect pre-approved or instant loan offer availability. Usually, only banks provide these to customers with good and clean payback records. A past settlement long ago pulls you out of that group.

Recovery Takes Time and Effort

Although it takes time, if you pay, your credit can be restored and eligibility reinstated. Rebuilding your credit profile calls for disciplined financial behaviour, including limited credit utilisation, consistent payments, and avoidance of new debt.

Maintaining a secured credit card or obtaining a small loan and consistently paying back it will assist borrowers also create strong repayment history.

Why Banks Are Cautious After a Settlement

To lenders, a personal loan settlement seems to be a breach of the original agreement. Even if it was partially paid for, the debt shows a past of financial struggle or mismanagement. This makes banks cautious about providing new money.

Your credit report exposes the record, which influences the impression of your profile to all possible lenders. This is why one should fully understand the trade-offs before deciding on settlement.

Is It Better to Settle or Restructure Your Loan?

Borrowers may have two options when it becomes difficult to pay back a personal loan: modify the loan or settle it. Though their long-term effects can be somewhat varied, both choices are meant to bring relief. Knowing the differences between settling and restructuring personal loans will enable you to select the one that most suits your financial circumstances.

What Is Personal Loan Settlement

Loan settlement is the procedure by which the borrower works with the lender to pay some of the remaining loan balance. Usually, this follows from regular payments stopping and the loan turning into a non-performing asset.

Should the borrower pay a lump sum less than the debt owing, the lender agrees to close the deal. It affects your credit profile even if it can halt collecting activities.

What Is Loan Restructuring

Restructuring a loan is modifying the terms of the original loan agreement without negating the existing balance. The bank can provide:

- Reduced interest rates

- Extended return period

- stoppage in temporary payment

The goal is to make loan repayment more reasonable depending on the borrower’s present financial situation. Still expected to be paid back is the whole loan amount.

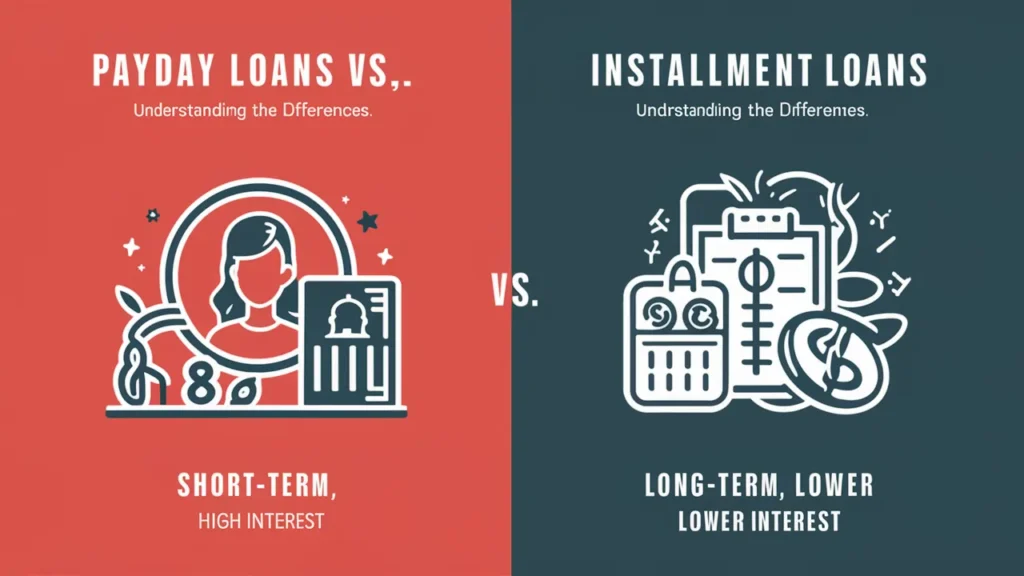

Settle vs Restructure Personal Loan: Key Differences

Impact on Credit Score

Credit records note loan settlement as “settled.” This situation suggests that the borrower did not satisfy the initial loan agreement. It might stay on the record for several years and reduce the credit score.

Although credit reports also include restructuring, its negative weight is not as great. Usually labelled as “restructured,” the account indicates that the borrower struggled financially but cooperated with the lender to keep making payments.

Future Loan Eligibility

Future loan eligibility is a main determinant of the settlement rather than the restructuring of personal loan choices. Settlement can make future loan applications more difficult. Many banks may reject loan applications or give higher interest rates, seeing a settled status as a danger indication.

Restructuring increases the likelihood of future loan acceptance usually. Lenders see it as evidence that the borrower tried to satisfy their loan commitment despite challenges.

Financial Flexibility

Settlement reduces the whole amount owing, so providing instant relief. But it sometimes calls for a lump-sum payment, which not all borrowers could be able to afford.

Restructuring lowers monthly payments or increases the loan duration, therefore offering relief. It lets borrowers control cash flow without having to set aside a lot at once.

Who Should Consider Settlement

For borrowers experiencing ongoing financial difficulty—job loss, business failure, or major medical problems—settlement could be appropriate. Settlement may be the only sensible choice if paying evelowered EMIs seems difficult and income is not projected to improve quickly.

Who Should Consider Restructuring

Those experiencing a temporary financial setback might be better suited for restructuring. Restructuring helps you retain your eligibility for future loans and preserves your credit score, whether your income is likely to return to normal or increase shortly.

Choosing wisely between settling against restructuring a personal loan depends on evaluating your present situation and long-term objectives.

Conclusion

Personal loan settlement could be a last option for borrowers in serious financial difficulty who find it beneficial. Lessening your debt load helps avoid legal problems, provides some peace of mind, and minimises recovery calls. Still, there are expenses. Years of a “settled” credit record will reduce your borrowing opportunities. This is the reason one should choose a settlement only when EMI modifications or restructuring are not possible. To prevent future financial or legal problems, always make sure the agreement is noted and get all relevant records from the bank. Your income, plans, and capacity to pay back will determine whether you should restructure or settle. Before choosing this big financial decision, be sure you truly grasp the trade-offs.

FAQ’s

Ans: Usually, in significant financial hardship, it occurs when the bank agrees to accept a one-time reduced payment to settle your loan instead of requiring the total outstanding amount.

Ans: Correct. Your credit report will show “settled” instead of “closed,” which lowers your credit score and can affect future loan approvals.

Ans: Those who find themselves permanently in financial trouble—such as those who are sick or have lost their jobs—who do not intend to take out additional loans soon could find this useful.

Ans: Restructuring is appropriate if your financial issues are temporary. It protects your credit score and offers long-term flexibility free of a lump-sum payment.