Summary

Personal loan settlement in 2025 lets borrowers pay a lower lump sum to finish a loan. This is for those who can’t pay the full amount. This generally happens when the borrower is having money troubles and can’t pay back the entire loan. The process involves assessing the position of your finances, contacting the lender, negotiating a final settlement amount, signing an agreement, remitting any sum you agreed to, and collecting formal documents of closure.

A settlement does not mean you default or face legal action. But it appears on your credit report and impacts your CIBIL score. People may view a settlement as a better option compared to a full default. You might consider better options, like debt consolidation, refinancing, or debt management plans. A settlement can help you regain control of your finances, but only use it as a last resort.

Introduction

Personal loan settlement in 2025 is a great choice for borrowers with money issues. A borrower can settle a personal loan with the lender. This means they can pay a lump sum that is less than what they owe. Personal loan settlement is helpful when someone can’t keep up with payments. This often happens due to job loss, a medical emergency, or high debt after their income drops. In these cases, they may need to tighten their budget.

Personal loan settlement lets people close their loan accounts without defaulting. It also prevents lenders from taking legal action. In personal loan settlement, the borrower contacts the lender. They ask about a fair amount and agree on a formal settlement. Personal loan settlement can ease stress. But it may impact your credit file and score when you settle. Knowing how it works allows you to determine if it is the right option for you to move forward.

What is Personal Loan Settlement in 2025?

Personal loan settlement in 2025 the borrower and lender agree on a lower lump sum. This sum pays off the borrower’s remaining loan balance. This usually happens when the borrower is having trouble with money and can’t pay back the whole loan. The borrower can settle the debt for a smaller amount instead of defaulting, which can hurt credit scores. This makes it easier to pay off the loan.

Why was Personal Loan Settlement in 2025 Important?

People have been struggling with money in the last few years, especially when economies are unstable. Personal loans are important for paying for things you need right now, but they can be a strain when you have other financial obligations. Personal loan settlement in 2025 became crucial. It helps people regain control of their finances. This way, they can avoid issues like defaults or bankruptcy.

How Does Personal Loan Settlement Work?

There are a few important procedures that need to be taken to settle a personal loan:

Assess Your Financial Situation

It’s important to know where you stand financially before you talk to your lender. Look over your monthly income, debts, and costs. If you can’t pay back the full loan amount, debt settlement is a good choice.

Contact Your Lender

After you’ve looked at your position, get in touch with your lender. You will need to tell them about your money problems and ask for a settlement. You will need to send in papers that indicate you can’t pay back the whole amount, like proof of income, bank statements, and a list of your debts.

Negotiate a Settlement Offer

The lender might give a lesser lump sum amount, which is less than the amount still owed on the loan. They will decide if they should settle the debt to keep trying to get the whole amount back. At this point, both sides talk about how much is fair and manageable for the borrower.

Review and Sign an Agreement

The lender will send you a settlement agreement once you and they agree on the terms of the settlement. This legally binding agreement spells down the lower amount you have to pay and any additional terms. Before signing, it’s crucial to read the agreement thoroughly to make sure there are no hidden costs or conditions.

Make the Payment

You must pay the whole amount by the date you agreed upon after you sign the contract. After the payment goes through, the lender will consider the loan paid off, and you won’t have to pay the rest of the debt.

Key Factors to Consider for Personal Loan Settlement in 2025

Impact on Credit Score

Before choosing a personal loan settlement in 2025, consider how it will impact your credit score. Even though debt settlement is better than defaulting, it might still hurt your credit score. Your credit report will probably show the settlement as “settled” or “partially paid,” which could make it harder for you to borrow money in the future. But many people think that settling the loan is better than not paying it off or defaulting.

Negotiation Skills

How successfully you can negotiate with your lender frequently determines how successful your loan settlement will be. If lenders think that settling is the best way to get some of the loan money back instead of continuing to collect or going to court, they are more likely to agree to it. Having the right paperwork and knowing what you can and can’t afford will help you in these talks.

Legal Implications

The loan settlement can’t be reached, lenders may take legal action in specific situations. Also you don’t pay off a loan or settle it, you need to know what the legal consequences are. If you can’t pay off the debt, talk to a financial advisor or lawyer who can help you figure out what to do next.

When Should You Consider Loan Settlement?

In many instances, loan settlement might be a smart idea:

Financial Hardship

A settlement could help if you are having trouble making your regular loan payments because your income has dropped a lot, you lost your job, or you had to pay for medical care you didn’t foresee.

Overwhelming Debt

If you have a lot of other debts in addition to your loan, loan settlement might help you pay off that one obligation, which would make it easier on your finances as a whole.

Avoiding Default

Loan settlement is a technique to pay off your debt without hurting your credit history as much as defaulting, which can have long-lasting impacts on your credit report.

Alternatives to Loan Settlement in 2025

You might wish to think about other options before choosing a loan settlement. These choices can include:

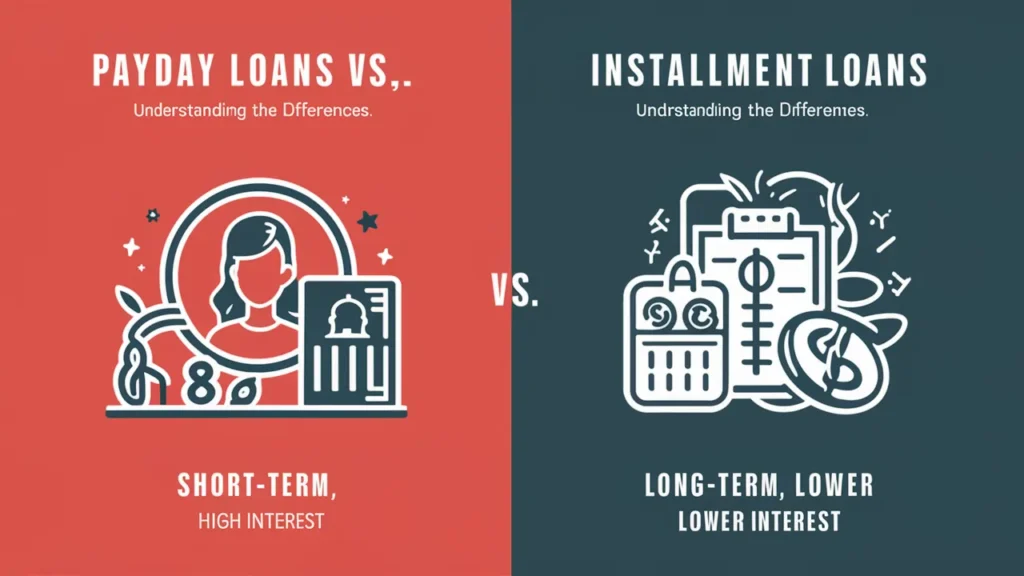

Debt Consolidation

When you consolidate your debt, you take out a new loan that combines several of your old loans into one with a reduced interest rate or a longer payback period. This could assist in lowering the monthly payments, which would make the loan simpler to handle.

Debt Management Plans

A debt management plan (DMP) is a systematic strategy for paying off your debts that you make with the help of a credit counselling service. People typically use this to assist them in paying off their loans in full over time without having to settle.

Refinancing

The Refinancing means getting a new loan with better terms to pay off the old one. Also Refinancing can be a better option if your credit score has gone up or you got a lower interest rate.

Debt management through personal loan settlement is a good idea, but it should only be utilised as a last resort. In 2025, it’s vitally important to know what your financial alternatives are and how each choice will affect your finances in the long run.

Step-by-Step Process to Your Personal Loan Settlement in 2025

If you’re having financial trouble and can’t pay back your loan fully, consider settling it for less than the full amount. The process of personal loan settlement in 2025 will assist borrowers in reducing their debt. It aims to do this with minimal impact on their finances. Below a basic and easy-to-understand settlement process guidelines.

Step 1: Review Your Loan Default Status

The first step to personal loan settlement is to thoroughly look at and understand the status of your loan. Knowing the details of the loan default missed payments, overdue interest, etc., will give you a aclearerr understanding of your debts and whether you could go down the route of a settlement. It is possible that if the loan has defaulted, you may be in a better position to negotiate a settlement that is reduced settlement.

Key Points to Check:

- Total outstanding loan amount

- Missed payments & late fees

- Any default/arrears State

- Your credit score impact

By considering this information, you’ll know exactly where you are when engaging your lender.

Step 2: Contact Your Lender’s Recovery/Settlement Team

After reviewing your loan default status, your next step is to get in touch with your lender’s recovery or settlement department. Most lenders and financial institutions have separate teams that deal with debt recovery and settlements, and speaking to them will allow you to explain your financial hardship and to ask for a settlement. You should initiate this communication as soon as you believe that you will not be able to repay your loan in full.

Things to Expect:

- A talk about your problem with financial hardship

- A discussion about your repayment history and current situation

- A request for supporting documents, for example, pay stubs, medical records, or proof of job loss

This first contact matters for setting the tone of your settlement talks. Be open and clear about your financial issues

Step 3: Submit a Written Request for One-Time Settlement (OTS)

After you have contacted the lender, the next step is to send a formal written request for a One-Time Settlement (OTS). This letter will describe how you are unable to repay the debt in full, and you will suggest a lump sum you would like to offer as a settlement. Be specific with the lump sum you are offering and when you can expect to have the payment ready.

What to Include in the Request:

- A comprehensive statement detailing your financial hardship

- The precise amount that you can pay as a lump sum

- Any documents supporting your situation (salary slips, bank statements, etc.)

A well-prepared written request is much more likely to obtain a positive response from a lender.

Step 4: Negotiate the Reduced Lump Sum Amount

After you have written your request and submitted it, your lender will evaluate your offer and may respond with a counteroffer. This will be your opportunity to negotiate. Lenders may start with a higher settlement number, so you’ll want to bargain to get the best offer possible within what you can afford. The primary goal here is to get to an amount that will be good, but well below the original loan amount.

Tips for Negotiating:

- Be definitive about as much as you can afford and stick with it.

- Provide any supporting documents that can help support your offer.

- Be patient and be willing to counter the lender’s offer if it is too much.

- If you can, ask for a longer payment timeline to better spread the lump sum.

Negotiating is frequently a back-and-forth process, so it is best to stay resolute but reasonable.

Step 5: Make the Payment Within the Agreed Timeframe

Once you agree on the reduced total settlement amount, the next step is to make a payment. Make sure to comply with the terms and comply within the designated time frame. If the settlement agreement allows for a lump sum payment, make sure to pay the entire amount in one payment. If there is an instalment arrangement, make sure to meet payment deadlines so that you don’t run into any issues.

Payment Methods:

- Bank transfer

- Online payment

- Cheque, if applicable

Ensure you keep proof of payment, such as transaction receipts, as evidence that the settlement was completed as agreed.

Step 6: Collect the Loan Settlement Letter and NOC

After you have completed the agreed payment, you must acquire the loan settlement letter and a No Objection Certificate (NOC) from your lender. These documents are official confirmation that the loan has been settled and all outstanding borrowings have been paid off. The loan settlement letter will have the terms of the settlement, and the NOC will confirm that the lender has no further claim on the loan.

Key Documents to Obtain:

- Loan settlement letter

- No Objection Certificate (NOC)

These documents are essential for clearing your financial record and can be important for your credit report moving forward.

By following this process step by step. You can settle your loan and start on the path to repairing your finances. The personal loan settlement in 2025 helps you pay off your debt. It also reduces the negative impact of defaulting on a loan or facing legal issues. Always be sure to negotiate properly and get all documents required when the settlement is finalised.

How Settlement Affects Your CIBIL Score in 2025

If you are struggling financially, one of the most often used ways to deal with outstanding debt is through a loan settlement. However, this can be a short-term solution that comes with long-term ramifications, especially to your CIBIL score. Understanding the impact of personal loan settlement in 2025 on your credit score is important. This knowledge helps you make smart choices about your finances.

How Settlement Affects Your CIBIL Score

Your CIBIL score is one of the main aspects lenders consider to evaluate your creditworthiness. This score is determined by many factors, including payment history, credit utilisation, and how old your credit accounts are.

When you repay a personal loan in full via a short sale, your lender will mark the loan status as “Settled” instead of “Closed”. This is important because the term ‘Settled” conveys the loan was not paid in full when originally agreed. It’s indicative of the fact that you chose not to honour the repayment in full from the original agreement, which is detrimental to your score.

The Immediate Impact

Once the loan is settled, the settlement is reflected in your CIBIL report and can cause a sharp drop in your credit score. While the drop may not be as significant as a default, it is still a red flag to future lenders. A settled loan shows that you were unable to fully repay your loan, and this may cause lenders to perceive you as a higher risk borrower.

How Long Does the Impact Last?

A settled loan can appear on your CIBIL report for a maximum of 7 years. While this doesn’t guarantee that you’ll be unable to receive credit again, the damage has already been done, and time may be a factor in mending things. The longer the settled loan remains on your report, the more difficulty in persuading lenders that you’re an acceptable borrower.

However, time and a plethora of good credit history with no additional defaults or settlements will slowly diminish the negative impact a settled loan has. It can, though, be forsaken in the short term when proceeding with applications for new loans or credit cards.

Settling Loans vs. Defaulting

Understanding the distinction between a loan settlement and defaulting on a loan is crucial. If you default on a loan, the lender sees you as unable to repay. Then, they often take stronger steps to collect the debt. Defaulting is usually seen as worse than a settlement. So, it harms your CIBIL score more. No matter the event, defaulting or settling will hurt your credit history. This can impact your creditworthiness when you apply for credit later.

Can You Improve Your CIBIL Score After a Settlement?

Yes, it’s possible to improve your CIBIL score after a loan settlement, but it requires consistent effort. Here are some ways to gradually rebuild your credit score:

- Timely Payments: Ensure all future loan or credit card payments are made on time. This will show lenders that you are responsible and can be trusted with credit.

- Reduce Credit Utilization: Keeping your credit utilisation below 30% of your total available credit can improve your credit score over time.

- Monitor Your Credit Report: Regularly check your credit report to ensure there are no errors or discrepancies. Disputing inaccuracies can also help improve your score.

- Avoid Additional Settlements: Avoid settling additional loans in the future, as this will further damage your credit report.

Will a Settled Loan Affect Your Loan Application?

When you apply for a new loan after paying off the last one, lenders look at more than just your CIBIL score. They also consider your overall financial health. “Settled” on your credit report will cause lenders to have reservations about lending you money. But lenders might still approve you if your income and debts meet their requirements.

How Can You Avoid Loan Settlement?

Managing your money wisely is the best way to minimise the adverse effects of a personal loan settlement in 2025. This includes making your loan payments on time and in full. If you’re having trouble repaying, talk to your lender about restructuring instead of going down the settlement route. Lenders are often very accommodating when you ask for short-term assistance with repayment in the form of long-term repayment or new interest rates.

Another way to avoid missing loan payments is to manage your priorities and expenses. And if you’re struggling financially and can’t get ahead, a financial or credit counselling expert is a great assistance.

Conclusion

Personal loan settlement in 2025 will be an option for those with high debt. It’s a last resort for people who can’t pay back the full loan amount. The settlement can ease stress now, but it might lead to serious problems later. Settling a loan impacts your credit. It can hurt your CIBIL report. This may make it harder to borrow in the future. Both full defaults and court actions have serious effects. Settling a loan is a better option.

Before deciding, borrowers should look at all options to repay debt. This includes refinancing or using debt management solutions. If settlement is the only way to pay off debt, try to negotiate an equal amount. Keep all your documents safe and make your settlement payments on time. This can lead to a good settlement. By taking these simple steps, you can secure a personal loan. This will help you regain control of your finances and protect your credit score.

FAQ’s

The process of a borrower agreeing to pay a small fee amount of the total outstanding amount to the lender to settle the remaining balance on a personal loan.

Yes, settled loans can be shown on your report as “Settled”, which can depress your CIBIL score and affect your ability to apply for loans in the future.

Yes, whilst both affect your credit, loan settlement is typically less impactful than defaulting or facing legal recovery.

Yes, you could look into alternatives such as loan restructuring or refinancing, or enrolling in a debt management plan.