Summary

While paying a personal loan may sound like a quick solution to get out from under debt, leaping in without evaluating other options like EMI restructuring or payment relief may spell disaster later. For a possible seven years, paying off too quickly without considering other options like EMIs restructuring or payment relief may reduce your credit score. Getting credit cards or subsequent loans grows more challenging with a “settled” record. Many borrowers also fall into committing to informal agreements, relying on untrustworthy recovery agencies, or neglecting final payment affirmation. Legal complications, harassment, and continued debt issues may all result from these moves. After payment, always verify agent credentials, require written records, and check your credit history. When any other payment approach is not possible, settling must be a last resort. Good decisions safeguard your future financially.

Introduction

Especially amid financial distress, paying back a personal loan may appear to be a straightforward solution to getting out of financial obligation. On the other hand, rash decisions made without thinking through the full impact may lead to long-term problems. A lot of borrowers are not fully aware that early loan settlement or without corrective measures, can weaken their credit score, leading to legal or financial issues later in life. From believing unscrupulous recovery agents to ignoring better options like E MI treatment, a variety of common mistakes can turn relief into regret. The biggest missteps consumers make while paying back personal loans—why timing matters, how settlement impacts your credit score, and written agreements and proof of payment. Knowing these key points will allow you to wisely decide and steer away from financial woes later.

Settling Too Early: Why Timing Matters in Personal Loan Settlement

While paying off a personal loan may seem like a speedy way out of debt, doing so too early can usually backfire. Many borrowers regret hurrying the decision, particularly considering its long-term consequences. Knowing the timing error in personal loan settlement will help you stay free from credit problems and financial difficulties down the road.

What Is Personal Loan Settlement?

Loan settlement is the agreement by a lender to accept a partial payment as complete and final closing of the loan. Usually, it follows a borrower who misses multiple EMIs and finds it difficult to pay back completely. To credit bureaus, the bank wipes off the remaining balance and notes the loan as “settled.”

Although it provides instant comfort, a settlement shows negatively on your credit report and may reduce your credit score.

Why Timing Matters in Settlement Decisions

Settling Too Early Can Hurt Credit Long-Term

Rushing into personal loan settlement when you still have the option to pay back another way is one of the biggest timing errors there is. If your financial situation is transient, settling early might harm your credit for years, usually more than if you had explored options like restructuring.

A “settled” status stays on your credit report for up to seven years and makes it more difficult to obtain credit cards, future loans, or even employment in finance-related industries.

You May Miss Better Alternatives

If you settle too early, you might not look at other sensible solutions. In many circumstances, banks provide loan restructuring, E MI deferments, or interim interest relief. Usually available before settlement is provided, these choices maintain your credit record better.

Many times, the timing error in personal loan settlement results from borrowers not seeking these options first.

When Is the Right Time to Consider Settlement?

Only After Exhausting All Other Options

The settlement of debt should come last, not the first reaction. Assuming you have tried:

- Raising your pay

- Cut costs.

- Bargaining for reduced EMIs

- Getting assistance from a credit counsellor

…and still can’t pay; then it could be appropriate to discuss a settlement.

Only in Real, Long-Term Financial Distress

Settle only if your financial circumstances—that of job loss, health issues, or company failure—are unlikely to change quickly. This strengthens the case when you are negotiating with the bank and helps to explain the bad credit report mark.

Think About the Future Before Settling

Many borrowers wish they had waited longer before making a settlement. Later on, they discover they might have paid in full or chosen simpler repayment schedules with a little more patience or help. Acting out of temporary pressure without a complete picture ofthe long-term impact, this is the basic timing error in personal loan settlement.

Ignoring Credit Score Impact: A Costly Settlement Mistake

When you’re under financial strain, loan settlement may seem like a comfort; yet, neglecting its impact on your credit score might cause long-term regret. Many borrowers focus just on temporary relief without realising the long-term harm it can do, thus, they make a credit score mistake in loan settlement.

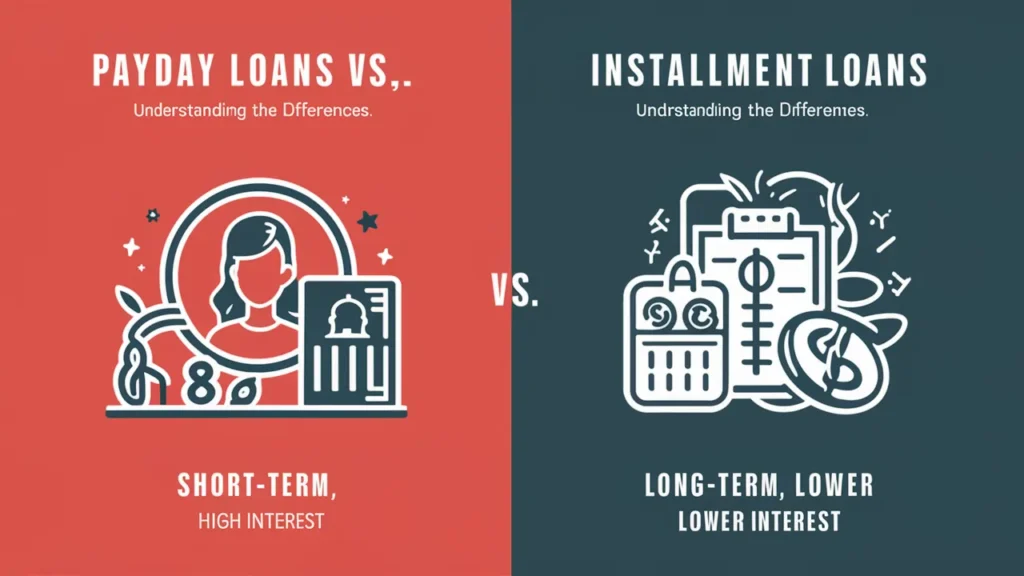

What Happens During a Loan Settlement?

When a borrower pays less than the entire amount owing, the bank agrees to close the debt as “settled.” Usually, following missed EMIs, this occurs when the borrower displays partial incapacity to pay back in whole.

Settlement is not the same as whole repayment even while it helps avoid legal action or recovery pressure. Particularly on your credit score, it has major ramifications.

How Loan Settlement Affects Your Credit Score

“Settled” Status Lowers Your Creditworthiness

The lender changes the credit bureaus CIBIL, Experian, or Equifax once your loan is paid off. The report states “settled” rather than “closed” or “paid.”

This status tells future creditors you were not able to pay back the whole loan. Usually, by 75 to 100 points or more, it seriously lowers your credit score. The primary credit score error in loan settlement is the undervaluation of the influence of one decision on your financial destiny.

Trouble Getting New Loans or Credit Cards

On your credit record, a settled status remains for up to seven years. Most lenders at this period could reject your applications or provide just high-interest loans. The record of settlement lowers your chances of receiving approval for house loans, auto loans, or even personal credit cards, even if your salary increases.

Not only your finances but also your goals—buying a house, financing a business, or establishing a great credit profile—may suffer from this damage.

When Borrowers Make This Credit Score Mistake

Settling Without Understanding Long-Term Impact

Many borrowers consent to settle in order to steer clear of calls from collection agents or legal action. They neglect to inquire, though, about how the bank will handle their credit report. Once individuals see theconsequencese of bad credit, this ignorance causes regret.

Assuming It’s the Only Option

Settlement is the only way some borrowers believe they can escape. Nonetheless, banks sometimes provide other options include altering the E MI, providing payment breaks, or temporarily lowering interest rates. These alternatives enable you to pay back without compromising your credit.

When debtors fail to seek alternatives or fully grasp the implications, the credit score error in loan settlement usually results.

Steps to Avoid the Mistake

- Ask the bank always how your loan closure will be recorded.

- Fir, think about part-payment programs or EMI rearrangement.

- Before deciding, talk with a credentialed counsellor.

- Select only a settlement if there is no reasonable means of complete repayment.

Not Getting a Written Settlement Agreement: A Legal Risk

Getting everything in writing when you’re settling a loan protects you more than it merely serves as a formality. Many borrowers make the crucial loan settlement agreement error of depending too much on verbal guarantees or inadequate documentation. Later, this might cause major financial and legal issues.

What Is a Loan Settlement Agreement?

When a loan is closed with partial payments, a loan settlement agreement—a legal document—is sent by the lender. It guarantees that the borrower paid the agreed-upon settlement and that the lender would regard the loan as settled.

- This agreement must mention:

- The paid total

- The settlement date is

- Complete and last confirmation of closure

- No further dues from either side

Without this paperwork, even after you thought the situation was settled, the lender may subsequently assert outstanding debt.

Why a Verbal or Informal Deal Is Risky

No Legal Protection

Informal correspondence from recovery agents or verbal pledges is not legally enforceable. Lack of a signed agreement on the official letterhead of the lender leaves no evidence of loan closure.

Many debtors of this loan settlement agreement error have been subject to legal letters, calls from different recovery agents, or even loan reactivation years later.

Credit Report Disputes

Should there be no written agreement even after debt settlement, the lender may not correctly update your credit record. This might maintain the debt under “written-off,” or “default,” which would damage your credit score.

By providing closure, a good agreement helps you contest erroneous information with credit bureaus.

Common Reasons Borrowers Make This Mistake

Trusting the Recovery Agent

Many borrowers believe the recovery agent will deal with the documentation. But rather than bank officials, agents are sometimes outside contractors. Once the money is paid, they can vanish or fail to follow up. Should a written record be absent, the bank may not accept the settlement.

Being in a Hurry

Borrowers sometimes hurry to pay only to relieve the tension while under continual calls or pressure. They overlook the need for appropriate documentation in the course of things. Seeking quick relief without considering the future leads to this loan settlement agreement error.

How to Avoid This Settlement Mistake

Always Ask for a Written Agreement

Ask the lender for a formal settlement offer before you pay anything. This should arrive on official letterhead signed by a designated agent. Get a No Dues Certificate and an acknowledgment once the payment is made.

Keep All Records

Save correspondence on the settlement, bank receipts, letters, and emails. These would be helpful in case of upcoming conflicts.

Verify Credit Report

Within a few weeks of settlement, review your credit record. Send a copy of your agreement to the credit bureau and the lender should the status not show as “settled.”

Dealing with Unverified Recovery Agents: How to Stay Safe

Dealing with visits or calls from recovery can be taxing. Interacting with agents that lack official verification, however, increases the risk much more. Many borrowers make a major error by trusting unidentified people without verifying their credentials when dealing with recovery agents. Harassment, fraud, or even legal conflict may follow from this.

Who Are Recovery Agents?

Banks or outside companies pay recovery agents to help to collect overdue loans. They should treat borrowers properly and equitably according to RBI-approved rules. Not every person professing to be a recovery agent, though, is trustworthy.

Some would be phoney agents attempting to con you. Others might be uninformed or run without appropriate permission. This is where the error about recovery agents frequently starts—by presuming that everyone who contacts you is formally assigned.

How to Identify a Verified Recovery Agent

Must Carry Official ID

Every recovery agent, according to the RBI guideline, must carry an identity card supplied by the agency or bank they represent. It should entail:

- Agent’s name and photo

- Name of bank or agency

- Contact details for verification

Before you speak with them, you are entitled to ask for this ID. You shouldn’t interact with someone if they refuse or avoid displaying ID.

Must Provide Written Communication

The bank should formally notify you about your outstanding debt before any visit. Someone showing up without official paperwork or previous notification could be trying to defraud

Common Mistakes Borrowers Make

Paying Without Verification

Paying money without verifying whether the recovery agency is permitted is one of the main mistakes one makes about them. Since the debt can still be regarded as outstanding, this might result in a loss of money and ongoing harassment.

Make always direct payments via official payment links or straight to the bank account given by the lender. Never fund a personal account.

Not Reporting Misconduct

Many borrowers decide to remain quiet if an agent threatens, mistreats, or acts unethically out of embarrassment or fear. The RBI does, however, quite explicitly forbid this kind of activity.

You should promptly report such misbehaviour to the bank and, should necessary, make a police complaint.

Procedures for Safely Dealing with Recovery Agents

Ask for Written Proof

Ask the bank for a written notice on your loan default and recovery action always. This proves that the visit or call is official.

Note Down Details

Look at the agent’s name, agency, and ID number. Keep a written or audio record for your safety should the encounter seem dubious or get hostile.

Contact the Bank Directly

Call the official customer care of your bank if you are not sure who is contacting you. They can verify whether the individual qualifies as a legitimate recovery agent.

Know Your Rights

Agents are required by the RBI not to get in touch with you before eight AM or after seven PM. They cannot also visit your office unless another way to get to you is not available.

Skipping Final Payment Verification: How It Can Backfire Later

While paying back a debt could seem like the end of a trying chapter, neglecting to confirm your last payment could lead to unanticipated issues. Many borrowers assume everything is OK once they pay the agreed-upon amount, so they make the last payment error in loan settlement. Not confirming the payment and its acknowledgement, however, might cause conflicts, credit problems, and maybe legal action.

What Is Final Payment Verification?

Verification of final payments involves making sure the bank formally closed your account and has your settlement amount. This encompasses:

- Ensuring the credit of the payment

- Obtaining an NDC, or No Dues Certificate

- Making sure your credit report shows “settled.”

A common and dangerous final payment error in debt settlement that can completely reverse the benefit of settlement is skipping this step.

Why This Mistake Can Be Costly

Bank May Not Acknowledge Closure

Technical problems or internal miscommunication occasionally could cause your payment to be incorrectly recorded. Should you fail to confirm, the loan may stay open in the system of the bank, even after your payment.

More recovery calls, legal notifications, or late fee additions could all follow from this. Without evidence of closure, you might have to pay once more or go through a drawn-out dispute process.

Credit Offer Might Show Inaccurate Status

The lender should update your credit record after a settlement, showing the loan as “settled.” Should they fail to do this, the report can list it as “written-off” or “active,” so unfairly damaging your credit score.

Not reviewing your credit record 30 to 60 days following the last payment is a common final payment error in personal loan settlement. Should the report not be updated, you have to ask the bankforr corrections and pay attentiototh the payment documentation.

What Borrowers Often Overlook

Relying on Verbal Confirmation

Many debtors feel the SMS alert is sufficient or rely on the word of the recovery agent. To terminate the account, though, banks want official actions. Proof of closure consists only of a No Dues Certificate or a settlement letter.

Not Saving Receipts and Letters

Not storing emails, transaction receipts, or correspondence about settlement is a common error. If you must defend yourself later, these records are vital.

Since there is no written proof to validate the borrower’s claim, this small final payment error in loan settlement usually becomes a more serious one.

How to Verify Final Payment Properly

Ask for a No Dues Certificate

Ask the bank on letterhead for a formal confirmation or No Dues Certificate following payment. This paperwork should make it very evident that the loan is paid off and that no balance exists.

Check Your Credit Report

Check your credit report with CIBIL, Equifax, or Experian 30 to 60 days after making the last payment. Should the status remain unaltered, dispute it and offer evidence of settlement.

Keep All Records

Save all letters concerning the settlement, emails, agency IDs, and receipts. These will guard you should conflicts with the credit bureau or bank arise, or future issues develop.

Conclusion

Paying back a personal loan can offer short-term peace, yet mismanagement of it can create long-term credit complications. Blunders like paying ahead, ignoring credit score impact, failing to have a signed contract, and not having a final payment verified can lead to regret and potentially more distress. Most of the borrowers rush without having a clue about alternatives or risks. Always explore options like EMI restructuring or receiving finance advice before settling. If you must pay, ensure you get it in written form, verify recovery agents, and check your credit report after the last payment. Being cautious and informed can ensure peace of mind, protect your credit score, and avert legal complications. Proper debt settlement revolves around a smart and careful attitude.

FAQ’s

Ans: Usually when the borrower cannot pay the entire loan, personal loan settlement is the agreement whereby a lender agrees to take a portion payment to conclude the debt totally.

Ans: Early settling may damage your credit score for years. Before agreeing to pay, it’s advisable to investigate choices such as loan restructuring.

Ans: By showing the loan is paid off, a written agreement legally shields you. Without it, the lender can still claim you owe money or notify credit bureaus of inaccurate information.

Ans: Always ask for an official ID; check their credentials with your bank; never pay money to anyone without appropriate documentation or formal receipts.