Summary

A spot loan is approved and credited right away, bypassing the time-consuming sanctioning procedure. Spot loans are typically used for emergencies like unexpected medical expenses, last-minute travel, or unanticipated financial needs. Spot loans are easily accessible via banks, NBFCs, online lending applications, and peer-to-peer lending websites and require less paperwork than conventional loans.

Two common types of spot loans exist: personal spot loans (to fulfill individual expenses such as holiday travel or health crises) and cash loans (funds lent in cash to spend on whatever the borrower prefers). The distinct features of a spot loan are speedy approval, fewer documents to present, limited duration for repaying, and relatively higher rates of interest as compared to conventional loans.

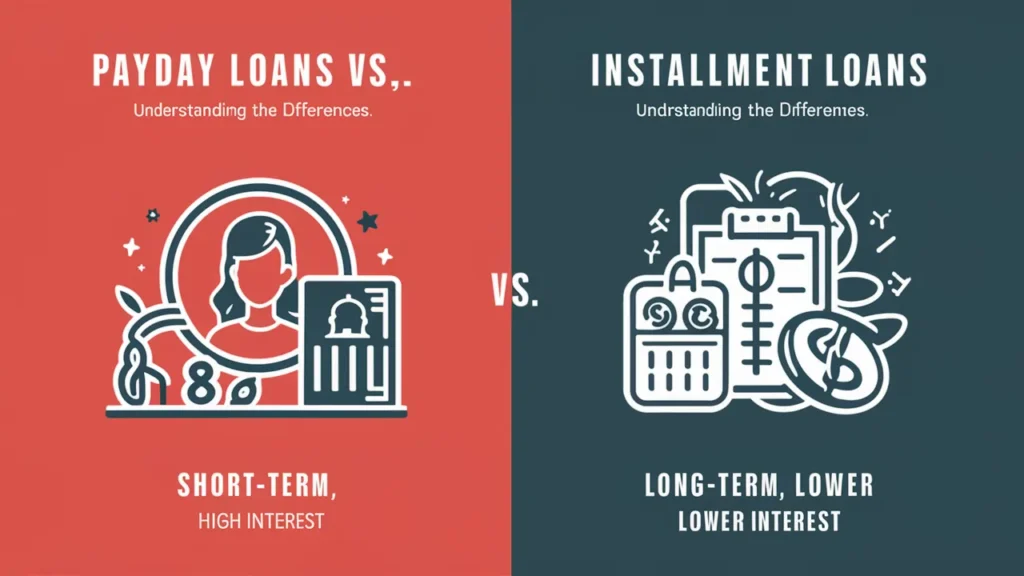

Although spot loans offer instant financial relief, they are risky as they have high interest rates, short repayment periods, and can adversely affect credit scores if repaid. Spot loans can be obtained by borrowers from different sources like personal loans, payday loans, credit card loans, and online lenders like Paytm Loans, KreditBee, and LazyPay.

Introduction

A spot loan is a loan that is approved and disbursed promptly without waiting time. Contrary to the usual loans, which involve a long review process, a spot loan offers instant financial assistance. Spot loans are generally borrowed for emergency purposes, such as medical emergencies, sudden travel, or unexpected expenses.

The quick approval of a spot loan is its biggest benefit. The lenders can receive the funds in a matter of hours or minutes due to the low documentation requirements and quick approval process of these loans. They are, therefore, a very good choice for anyone who wants quick cash without having to wait days.

But spot loans do have some drawbacks. Since they are for immediate approval, the interest rates are higher than regular loans. The lenders demand more since they take greater risks by offering unsecured and instant loans. Also, the repayment period is shorter, from a few weeks to a few months.

Normally, spot loans are most suitable for cash requirements in case of an emergency but involve extremely high interest and a short payback duration. Spot loan borrowers should shop around in terms of lenders, read loan agreement terms attentively, and be prepared to make the repayment at maturity.

What is a Spot Loan?

A spot loan is a kind of loan that you can obtain quickly or instantly. It is also called an “instant loan” because you do not have to go through a long process for this loan, and it is ready quickly. Typically, this loan is taken out for modest purposes like house maintenance, travel, or emergency costs.

Spot loans are simple to obtain online or at a bank or other financial institution, and they involve less paperwork and less time. Even though this loan’s interest rate could be a little higher than that of a typical loan, it’s a quick and simple solution if you need money right away.

How many types of Spot Loans are there?

Spot loans are mainly of two types:

- Personal Spot Loan: This loan is taken for the personal needs of the individual, such as marriage, travel, or any medical emergency. It can be obtained immediately and requires fewer documents.

- Cash Loan: This loan is given to you as cash. You can use it in any situation, such as for daily expenses or sudden needs.

What are the features of Spot Loan?

The following are some of the key features of this loan:

- Spot loans can be obtained instantly; that is, the loan is available within a few hours. It does not require a long process.

- You need very few documents for this loan. Usually, identity proof and address proof are sufficient.

- The application process for a Spot Loan is straightforward. You can get it quickly online or by visiting the bank.

- This loan is usually given for a short period, such as a few weeks or months.

- The interest rate of a Spot Loan may be slightly higher than a normal loan, as it is given immediately.

- You do not need a very good credit score to get a Spot Loan. However, this may affect the loan amount.

What are the eligibility criteria for a Spot Loan?

The following are the eligibility criteria for availing of this loan:

- Your age should be between 18 and 60 years to avail of a Spot Loan. Some institutions may also keep it between 21 and 60 years.

- You should have a stable source of income, such as a job or business. Usually, to avail of a loan, you should have an income of at least Rs 20,000-25,000 per month, which is sufficient to repay your loan.

- You should have a good credit history. Most institutions give loans only to individuals with a credit score of 650 or above, which shows that you can repay your loan on time.

- You should be an Indian citizen. Some institutions may also ask for a residence certificate, especially if you are going to take a loan in a particular area.

- You need some documentary proof of your identity (Aadhaar card, PAN card, etc.), address (proof of residence), and income (salary slip, bank statement, etc.).

What documents are required to take a spot loan?

These documents are usually the following:

ID Proof

Address Proof

- Aadhar Card

- Electricity or Water Bill

- Bank Statement

- Ration Card

Income Proof

- Salary Slip (last 3 months)

- Bank Statement (last 6 months)

- Income Tax Return (ITR), if you do your own business

Employment Proof

- If you do a job, then a company certificate or joining letter

- Salary slips for the last few months

Photograph

- A photograph of yours is also required to take a loan.

What are the risks of taking a Spot Loan?

There may be some risks in taking this loan, which you should be aware of:

- The interest rate of a Spot Loan is higher than that of a normal loan. This may cost you more to repay the loan.

- Since a Spot Loan is usually small and immediate, if you do not repay it on time, interest and penalties may increase.

- If you do not repay the Spot Loan installments on time, it may affect your credit score, making it difficult to take a loan in the future.

- A Spot Loan is for a short period, so you have to repay it quickly. Sometimes, this may feel like pressure and cause you difficulty.

- Many times, a Spot Loan is just for immediate needs, but it can be misused, which may cause you to face financial problems.

What are the options available for taking a Spot Loan?

Following are some of the major options:

| Personal Loan | This loan is given without any guarantee, and you can take it for any personal need, like medical expenses or travel. It can be easily availed from banks and financial institutions. |

| Online Loan | Many companies and banks now provide the facility of giving loans online. You can apply through the website or app from the comfort of your home and get the loan quickly. |

| Payday Loan | This loan is given based on your next salary. In this, you get the loan quickly, but it has to be repaid quickly. |

| Credit Card Loan | If you have a credit card, you can also use it to avail a loan. You can get the amount instantly, and you can repay it in easy EMIs. |

What are the pros and cons of taking a Spot Loan?

Pros (Advantage)

- You get money fast in the case of a Spot Loan, which is its biggest benefit. It helps in situations requiring immediate funds, like going to the doctor or dealing with broken pipes in the house.

- Spot Loans require less paperwork. Apply online is quite easy as well.

- Approval of your Spot Loan happens quickly; therefore, you don’t have to deal with an extended process.

- This loan can be used according to your wish, such as for traveling, for education, or other purposes.

Cons (Disadvantage)

- High interest rates for Spot Loans. It gets even more costly if you are not in a position to repay. Pressure on the financial situation would increase as they have to be repaid quickly.

- If it is not repaid on the date, then that might decrease your credit score, which would cause obstacles in borrowing a loan later.

- In some places, there are additional fees charges with a loan, of which you may not even be aware. So, the loan terms and conditions have to be read carefully.

Which are the institutions providing Spot Loans?

Several institutions offer spot loans that can broadly be classified under the following headings:

Banks

Banks must provide personal loans as spot loans to customers, especially for those who have a pre-approved loan offer. Examples include;

- HDFC Bank: Instant personal loans for existing customers.

- ICICI Bank: Quick disbursal of the pre-approved loan.

- SBI: Specific schemes involving quick processing loans.

Non-Banking Financial Companies (NBFCs)

NBFCs are known for speedy loan processing. Some of the examples include:

- Bajaj Finserv: They are offering instant personal loans through their website.

- Tata Capital: This company gives quick loans with less paperwork.

- Muthoot Finance: Primarily into gold loans, which often release the loan on the same day.

Digital Loan Apps

These are modern, application-based lenders who provide on-the-spot loans within a few minutes. Some prominent ones are:

- Paytm Loans: This app gives quick personal loans.

- KreditBee: Gives on-the-spot small-ticket loans.

- LazyPay: Buy-now-pay-later services and small personal loans.

Peer-to-Peer Lending Platforms

These are platforms like Faircent and Lendbox that bring borrowers together with individual lenders and can provide spot loans quickly.

Credit Cards

Though not exactly loans, credit cards provide cash withdrawal facilities or loans against.

credit limit. This can be termed as a spot loan for emergency needs.

How to apply for a Spot Loan?

You can apply for this loan by following the following steps:

- First, you have to select a trusted bank, financial institution, or loan app that offers Spot Loan. You can visit their website or mobile app.

- Go to the website or app and fill out the loan application form. In this, you have to fill in your personal information like name, address, income, occupation, etc.

- After this, you have to upload documents of your identity (Aadhar card, PAN card), address (electricity bill, bank statement), and income (salary slip, bank statement).

- You have to choose the loan amount and repayment period as per your need. On some platforms, you can also see the loan terms and interest rates.

- After filling in all the information and documents correctly, apply now.

- After the application is reviewed, if everything is correct, the loan is approved. Then, the loan amount is transferred to your account.

Conclusion

A Spot Loan is one very convenient financial tool. It can provide you with cash instantly when you most need it. The loan is done rapidly, and much paperwork is avoided. It may be helpful when one suffers from a medical condition or has to fix a house or during any emergency spending.

However, taking a Spot Loan is associated with several risks. These loans always have a higher interest rate and may hamper your financial position if not paid on the due date. Other than this, an early payment requirement and some hidden charges can also cause trouble for you.

So, before taking a Spot Loan, you must know your requirements, loan terms, and interest rates. You should take the loan only after deciding on the repayment method and timeline. If you take a loan responsibly and repay it on time, then it can prove to be a good option for you.

Frequently Asked Questions (FAQ’s)

Ans: If you repay the Spot Loan on time, it can positively impact your credit score. But if you fail to repay the loan, it can harm your credit score.

Ans: Spot Loan needs documents like identity proof (Aadhar card, PAN card), address proof (electricity bill, bank statement), and income proof (salary slip, bank statement).

Ans: You can pay Spot Loans through EMIs in equal Monthly Installments. Here, you get a pre-mentioned date and amount for your loan.

Ans: Yes, it is quite quick, usually in the case of online platforms and apps. The processing takes a few hours or days.

Ans: Yes, you can take a loan within the limit of your credit card. This is called a credit card loan, in which the amount is received immediately.