When a person or business cannot repay the loan taken for itself, it negotiates with the bank or financial institution to find a solution. This process is called Loan Settlement. It is an agreement in which the bank and the borrower mutually decide that the borrower can end his loan by paying a part of the total outstanding amount. In this, the bank does not forgive the entire amount to the borrower but leaves some amount by agreement.

Many times it happens that the person’s income suddenly decreases, he loses his job, or due to any other financial problem, he cannot repay the loan installments on time. Due to this, the burden of interest on the borrower starts increasing and he comes under the category of defaulter. In such a situation, Loan Settlement becomes an option that relieves the borrower.

Although Loan Settlement can be a way to overcome the financial crisis, there are some advantages and disadvantages associated with it. It reduces your immediate financial burden but can hurt your CIBIL score. Therefore, it is very important to understand the advantages and disadvantages before adopting it.

In today’s article, we will discuss every aspect of Loan Settlement in depth so that you can understand whether this process is right for you or not.

What is Loan Settlement?

Loan Settlement is a process in which you reduce your loan outstanding debt and decide on a new amount. This means that you settle for a part of the loan that you are unable to repay by agreeing with the bank or loan company.

For example, if you have an outstanding loan of ₹ 1,00,000 and you are not able to repay the full amount, then the bank can offer to take a lesser amount from you such as ₹ 60,000. After this process, your debt is completely settled.

However, adopting this can affect your credit report, and it may be difficult to take a loan in the future. This option is for those who are unable to repay the loan, but it should be adopted wisely.

What are the benefits (Advantage or Pros) of loan settlement?

Here are some of the major benefits:

- If you have not been able to repay the loan for a long time, you can negotiate with the bank to reduce or repay the loan, which can make it easier to implement other financial plans in the future.

- Reducing the increasing pressure of debt can reduce mental stress, as you are now ready to repay a pre-decided smaller amount.

- After settlement, you have to pay a lesser amount instead of the full amount. For example, if you have an outstanding amount of ₹ 1,00,000, the bank may offer to take ₹ 60,000 from you.

- After loan settlement, your loan is over, giving you peace of mind and relief from the pressure of debt.

- If you tried to repay the loan on time and then settled, your credit report may improve, although it may be slightly affected.

How does loan settlement work?

Loan settlement is a process in which you compromise with the bank by reducing your outstanding amount. If you are unable to pay the entire loan bill and are facing problems in repaying the loan, then you can contact the bank and request to settle the loan.

The bank will negotiate with you and may offer you to pay a lesser amount. This usually happens when the bank feels that it is difficult to repay the entire amount, and they are ready to accept only a part of the loan.

After settlement, you have to pay the stipulated amount, and then your loan is completely over. However, this process can affect your credit report, and it may be a little difficult to take a loan in the future. Therefore, one should think carefully about all aspects before using it.

What are the eligibility criteria for Loan Settlement?

There may be some conditions and eligibility criteria for settlement:

- Generally, you are eligible for settlement only if you have a large outstanding loan amount and you are not able to repay it on time. The bank does not offer settlement for small dues.

- If you can prove that you are not in a position to repay your loan bill in full (such as loss of income, medical emergency, etc.), then you can apply for settlement.

- If you are not able to pay the loan bill regularly for a few months, then the bank may give you the option of settlement.

- You have to contact the bank and explain your financial situation to them. Only after this, they will consider your settlement process.

- The bank can reduce the total amount of your loan during settlement, but for this, you must have the option to accept the terms of the bank.

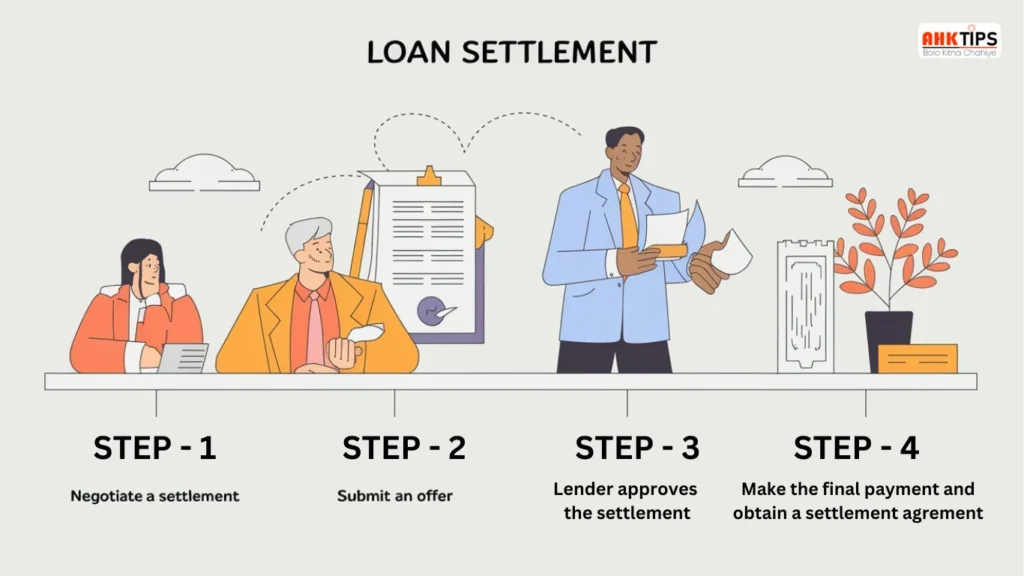

What is the process of Loan Settlement?

The settlement process is simple:

- First, you approach the bank or financial institution that issued your loan. You explain your financial situation, such as why you are unable to repay the loan.

- After the bank understands your situation, they will give you a settlement offer. This will reduce your total loan amount and provide a new payment proposal.

- If you find the bank’s settlement offer acceptable, you agree to its terms. This usually involves paying a reduced amount.

- As per the settlement terms, you have to repay the stipulated reduced amount either in one go or in a few installments. Once this amount is paid, your loan is over.

- After the payment is complete, the bank will give you a certificate or confirmation in writing that your loan amount has been fully cleared.

What are the things to keep in mind while doing settlement?

- Loan settlement can hurt your credit report, which may make it difficult to get a loan in the future.

- Read and understand the proposal given by the bank for settlement carefully. It is important to know how much amount is to be paid and what are the additional conditions.

- The bank may reduce your outstanding amount in settlement, but this does not mean that your responsibility is completely over. You have to repay the reduced amount on time.

- It is very important to make the payment within the time limit set by the bank. If you do not pay on time, the settlement process may be canceled.

- The entire settlement process should be taken in writing, such as getting a written confirmation from the bank that your loan amount has been completely settled.

- Once you settle, you should focus on your expenses and avoid taking loans again.

- If you think you can avoid the settlement process, first consider other options such as EMI consolidation, loan refinancing, etc.

What are the measures to improve CIBIL score after settlement?

Some measures can be taken to improve the CIBIL score properly:

- The most important thing is to pay the bill of any loan or debt on time in the future. Making timely payments improves your CIBIL score.

- Keep in mind the credit limit on the loan. Do not spend more than 30% of your credit limit. This will improve your CIBIL score.

- The less debt you have, the better your CIBIL score will be. If you have many loans, try to repay them quickly.

- Check your CIBIL report from time to time and make sure there are no mistakes in it. If there is any wrong information, contact the bank to correct it.

- Avoid taking new loans after loan settlement, as it can hurt your CIBIL report.

- Use online and automated payment options to make loans, loans, or other payments on time, so that you do not forget.

- Make a well-informed decision before taking a new loan. If not needed, avoid taking it.

Is loan settlement the right option?

It is important to keep some things in mind before adopting it:

- Loan settlement can reduce your credit score, as it shows that you have not repaid your entire loan amount. This can make it difficult to get a loan or loan in the future.

- If you are unable to repay the loan for a long time and other options like loan refinance or EMI plan is not working, then settlement can be a good solution.

- Settlement ends your loan, but for this, you have to compromise with the bank and agree to some terms. You have to pay a fixed amount, which can be less than your dues.

- Settlement is a serious decision, as it can affect your credit report. Consider all aspects before opting for it and make sure it is right for you.

What are the ways to avoid settlement?

- The most important way is to pay your loan bill on time. If you pay on time, you will not need a settlement.

- Spend within your loan limit. Overspending can increase your debt, which can make it difficult to repay it later.

- If you are unable to pay the entire bill at once, you can opt for paying on EMIs. This will give you more time to repay the loan and you will not need settlement.

- If your income is low, take measures to increase income like taking up a part-time job or any additional work, so that you can repay the loan easily.

- Keep the loan limit limited according to your expenses. This will help you avoid overspending.

- Set up automated payments for your loan bills so that you never forget to pay and make timely payments.

- Keep a proper track of your expenses and income and create a budget. This will help you understand your financial situation and repay your loan on time.

What are the disadvantages (Drawbacks or Cons) of doing loan settlement?

- After settlement, you have to pay a lesser amount at once, but if you do not repay this amount on time, then you may have to face more trouble.

- In some cases, if you are unable to repay your amount even after settlement, the bank can also take legal action.

- After settlement, you have not repaid your entire loan amount, which can lead to mental stress and financial problems in the future.

- Doing loan settlement can reduce your CIBIL score, as it shows that you have not repaid your loan amount in full. This can make it difficult to get a loan in the future.

- After settlement, the bank will not see you as a reliable customer, and may not give you a loan easily in the future.

- If you take a loan again, the bank can fix higher interest rates for you, because it saw that you had not repaid your loan amount in full earlier.

Conclusion

Loan Settlement is an option that can be a relief for those who are not able to pay their loan on time. This process is an agreement between the bank and the borrower, which allows ending the loan by paying part of the outstanding amount. However, it is very important to understand all its aspects thoroughly before adopting it.

The advantages of doing loan settlement are that it can save you from increasing interest and legal proceedings. It immediately helps to stabilize your financial situation and gives you a chance to improve your financial condition. But its disadvantages are also no less important. Its biggest impact is on your CIBIL score, which may make it difficult to get new loans in the future.

If you are considering loan settlement, then adopt it as the last option. First of all, talk to your bank, and get information about your loan restructuring or other alternative plans. If there is no other option left, then only decide on loan settlement.

Frequently Asked Questions (FAQ’s)

Ans: You may need your identity card, loan documents, income certificate, and documents related to your current financial status.

Ans: Yes, when you pay the settlement amount, the bank provides you with a No Due Certificate.

Ans: Loan settlement affects your credit score, which may make it difficult to get a loan in the future. However, you can apply for a loan if you improve the score over time.

Ans: In a loan settlement, you have to pay a part of the outstanding amount, whereas in a loan waiver, the entire amount is waived off.